The naira has been in a race to the bottom at both the official and unofficial foreign exchange markets since the Central Bank of Nigeria (CBN) allowed the official rate to weaken in June.

The step taken last June was the right one, according to analysts; however, the CBN seems to have slowed down on the pace of reforms necessary to complement the bold reform.

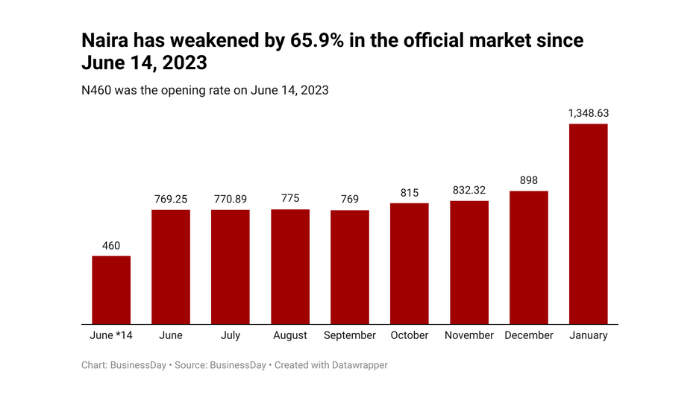

The naira has tumbled by 66 percent at the Nigerian Autonomous Foreign Exchange Market (NAFEM), also known as the official market. The currency has also plunged 47.9 percent on the streets otherwise known as the black market.

On Monday, the naira depreciated to N1,348.63 per dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM), the lowest level on record.

That’s after a revision of the methodology used to set the exchange rate which is aimed at addressing fluctuations in the FX market and ensuring rates accurately reflect market conditions.

This brings the exchange rate closer to the parallel market rate of N1,460 per dollar as of Tuesday morning but traders expect a further fall in the coming days as dollar shortages worsen.

The following charts paint a picture of the tumultuous journey of the naira at the official and unofficial markets since the big shift towards a market-reflective rate last June.

BusinessDay compiled the closing rates on June 14 after the CBN allowed the currency to weaken and for each month through Tuesday, January 30.

Since the foreign exchange reforms in June 2023, Nigeria has battled volatile exchange rates, although the CBN governor Yemi Cardoso, who replaced Godwin Emefiele last September, has promised true price discovery.

The CBN made the move to attract inflows, improve liquidity and end the manipulation of the exchange rate but the efforts are yet to bear fruit.

The currency of Africa’s largest economy has continued to slide freely since the reforms. The Cardoso-led central bank has blamed inadequate dollar liquidity for exacerbating price swings and promised to boost supply to clear a backlog of foreign exchange demand.

In a circular published Monday, CBN said its attention had been drawn to authorised dealers reporting “inaccurate and misleading information on transactions” which would henceforth attract sanctions.

“Ongoing investigations have revealed instances of underreporting of transaction rates. Deliberate attempts to create price distortions by reporting false transaction details amounts to market manipulations which will henceforth face sanctions,” the report said.

While naira has continued to slide at the official window, it has equally persisted in its freefall at the black market.

After the CBN made the move to liberalise the foreign exchange at the NAFEM in June 2023, the naira has since weakened. It rose from N769 in June and closed at N1200 in December of the same year.

The rate at which naira is soaring has begun to put a strain on household budgets, especially for those on low incomes, analysts say.

As the value of naira continues to fall, it invariably implies that its value in people’s pockets will decrease, meaning they can only buy less with the same amount of money at hand. This will lead to a decline in standard of living.

The continued depreciation in naira has been attributed to strong demand for the greenback. Also, fiscal policies, external trade, and global market trends, including inflation rates, interest rates, policy events, and geopolitical factors, are key influencers affecting the naira’s performance.