…The Economist projects further decline in 2024

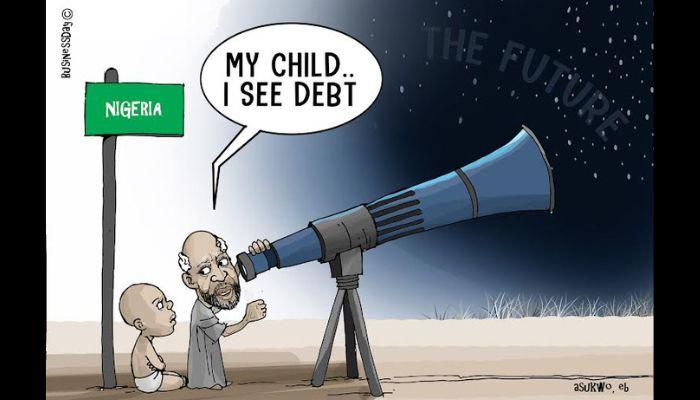

Nigeria’s debt service-to-revenue ratio dropped to the lowest in four years for the first nine months of 2023 largely on the back of the federal government reforms, a BusinessDay analysis shows.

BusinessDay analysis of the data from the Budget Office of the Federation shows that debt servicing bill in Africa’s biggest economy gulped 66.9 percent (N5.79 trillion) of total revenue of N8.65 trillion in the first nine months, lower than 99.3 percent (N4.23 trillion) in the same period of 2022.

Experts say the fuel subsidy removal and the unification of all segments of the foreign exchange market, which have increased revenue inflows for the government, have also improved the fiscal space and the allocation of more funds for capital projects to boost economic growth.

“Last year was a reverse from the previous trends because revenue growth was driven by the removal of oil subsidy and the unification of the foreign exchange markhttps://businessday.ng/news/article/nigerias-debt-to-hit-n95trn-up-eightfold-in-10yrs/ets,” Adeola Adenikinju, a professor of economics and president of the Nigerian Economic Society, said.

He added that the government will now have more revenue to undertake more activities either in terms of infrastructure or commitments to contractors and workers.

Damilare Asimiyu, macroeconomic strategist and head of investment research at Afrinvest West Africa Limited, said the interest that was meant to be paid on Ways and Means debt was suspended because of the securitisation of loans from the Central Bank of Nigeria (CBN).

“So, there should be more funds for the government to increase the capital budget because that has always been the sacrificial lamb. They will now have good headroom to increase allocation to capital projects,” he said.

Read also: CBN, foreign airlines clash over $700m trapped funds

Since President Bola Tinubu announced petrol subsidy removal during his inauguration on May 29, pump prices have tripled to N617, while the value of the naira has plunged following the floating of the currency.

In June, the CBN merged all segments of the FX market into the Investors and Exporters window and reintroduced the willing buyer, willing seller model.

The naira has continued to depreciate against the dollar and other major foreign currencies since then.

The official exchange rate fell from N463.38/$ to N1,348.6/$ as of Monday. At the parallel market, the naira is now pushing above N1,500/$ from 762/$.

“The reforms have had a major impact on revenue even though they are creating hardship for people. But it has improved the fiscal space and it is likely to improve more by the time we begin to see the impact of the reforms around tax and independent revenue,” Muda Yusuf, chief operating officer of the Centre for the Promotion of Private Enterprise, said.

According to him, the macro indicators are looking good, especially in the fiscal space. “The fiscal deficit will be lower because you have more revenue to support the economy, only if the money is spent well.”

The Economist, a British weekly newspaper, highlighted last week that many politicians seemed keener to spend on themselves, rather than create the conditions for peace or fill the country’s fiscal hole.

“Even if Tinubu resists the temptation to reinstate the petrol subsidy that he largely removed last year, debt servicing alone in 2024 may gobble up 61 percent of revenue,” it said.

During the public presentation of the country’s 2024 budget proposals in November, Abubakar Bagudu, minister of budget and economic planning, said the federal government achieved N8.65 trillion in revenue in the first nine months of 2023 from its pro-rata target of N8.28 trillion.

He said N1.42 trillion was generated from oil revenues, while non-oil revenues totalled N2.50 trillion.

Africa’s most populous nation has seen its public debt grow steadily to levels that have left many worried as government revenues remain low. Its debt-to-GDP ratio was increased from 25 percent to 40 percent in 2021.

Over the past nine years, the actual cost of servicing debt has been more than the budgeted amount. In the first nine months of 2023, it rose to N5.79 trillion from N908.9 billion in the same period of 2015.

The Debt Management Office said in September that the total public debt rose to N87.38 trillion in the second quarter of last year from N49.85 trillion in Q1. It increased to N87.91 trillion at the end of Q3.

The position of the current administration on debt is quite different from the previous administration, said Israel Odubola, a Lagos-based research economist

“They did more of multilateral loans to finance their debt. But I think this current administration is taking another approach to debt management as they are looking for more innovative ways of generating revenues,” he added.

The reforms also increased the disbursement by the Federation Account Allocation Committee (FAAC) to the three tiers of government.

Data from the National Bureau of Statistics (NBS) shows that it rose by 65.3 percent to N1.62 trillion in December from N976.3 billion in May.

The percentage increase is higher than the 42.2 percent recorded within the same period of 2022.

The Nigerian Economic Summit Group (NESG) said in its macroeconomic outlook report for 2024 that Nigeria witnessed an upturn in revenue, attributed to sustained high crude oil prices amid the Russia-Ukraine conflict, notwithstanding challenges in domestic oil production.

Read also: Eight things to know about Nigeria Infrastructure Debt Fund

“The expeditious removal of fuel subsidies by the new administration and the harmonisation of FX market rates further propelled growth in oil revenue,” it said.

The NESG recommended that the country must significantly decrease its current public debt service-to-revenue ratio, aiming for a reduction to less than 22 percent from the current high of 80.2 percent as of 2022.

“This reduction is crucial to create fiscal space, enabling the government to reallocate funds toward economic development and stability initiatives,” it said.

Over the past eight years, Nigeria has slumped into two recessions owing largely to the collapse of oil prices and disruptions caused by the COVID-19 pandemic.

Before the National Bureau of Statistics (NBS) adopted a new methodology for labour statistics, unemployment had quadrupled to 33.3 percent as of Q4 2020 from 8.2 percent in Q2 2015. It was put at 4.2 percent for the second quarter of 2023.

The country’s inflation rate, a measure of the general price level which has been in double digits since 2016, rose to 28.92 percent in December from 28.20 percent in the previous month.

In the third quarter of last year, foreign investments into Nigeria dropped to $654.7 million, the lowest level since the NBS started collating the data in 2013.

Read also: Nigeria’s debt burden: Soaring repayment amid dysfunctional education, health sectors

Lawmakers approved in December the request for the securitisation of the N7.3 trillion owed by the federal government to the CBN. This will push the country’s public debt stock to at least N95.2 trillion.

A recent report by PwC Nigeria said Nigeria’s rising debt service cost may affect the country’s debt servicing ability, credit rating outlook and borrowing cost.

The professional services firm projected that debt service could rise from N8.25 trillion in 2024 to N9.3 trillion in 2025 and to N11.1 trillion in 2026.

“With a high debt servicing to revenue ratio, the government aims to increase domestic debt in 2024 to meet its deficit funding requirements,” it said.

It said the shift towards more domestic borrowing could impact the private sector, as government credit constituted 37 percent of net domestic credit, which saw a 28 percent increase from January to September 2023.

“Additionally, Nigeria grapples with a low domestic credit-to-GDP ratio of 12 percent in the first quarter of 2023, lagging behind countries like South Africa, Egypt, and Morocco.”