Opay, PalmPay, and Moniepoint are the winners of the ongoing technology upgrades by deposit money banks which have left many customers stranded, according to industry experts and feedback from Nigerians.

This situation is reminiscent of 2023 when OPay and PalmPay experienced a surge in usage after traditional banks struggled to handle increased online transactions.

In March 2023, both apps were Nigeria’s most-downloaded finance apps, and OPay became the country’s most-downloaded app by October 2023. Mobile money transactions, dominated by both fintechs, surged by 348.11 percent to N41.54 trillion between January and July 2024, up from N9.27 trillion in the corresponding period of 2022. They earned this by gaining credibility through reliability.

“They made payment methods easier, faster, and better, and people began relying on them for everyday things,” said Adedeji Olowe, founder of Lendsqr.

The ongoing banks’ IT upgrades are intended to prevent a repeat of the transfer failures that occurred during the Central Bank of Nigeria’s (CBN) now-withdrawn cashless policy. However, these disruptions have driven more Nigerians to turn to OPay, PalmPay, and Moniepoint for transactions.

“OPay and other neobanks have been the biggest winners of the last two weeks,” stated Bolaji Akinboro, chairman of Voriancorelli and co-founder of Cellulant.

“Most Nigerians now have wallets from neobanks. When the traditional banks went down, those with money in their wallets could conduct peer-to-peer transactions within the same ecosystem.”

Read also: Banks’ IT upgrades give customers unexpected headache

Real-Life Impact

In 2023, Olamide Eniola opened an OPay account when transfers from her bank weren’t going through. During the recent bank IT upgrade, her OPay account saved her again. “I couldn’t access my salary for about a week, but someone told me about a feature on the app. You can link another bank’s card to your OPay account and transfer money between third banks using the OPay app. That’s what saved me,” she explained.

Lolade Akanji, a customer in one of the traditional banks, shared, “My traditional bank’s app is working now, but I opened an OPay account because I don’t want to go through that experience again.”

Temiloluwa Abdulrazak, another customer of a traditional bank, noted: “I had to download PalmPay when my bank app wasn’t opening.”

Nigerians have also shared their experiences on social media. One user on X, @cremechic11, tweeted, “The speed of OPay is unbelievable. Took me all of 2 minutes to set up my account and start transactions.”

Another X user, @FoluShaw, wrote: “Since my bank sent out the email and text messages to notify us that they will be upgrading their systems and we may not be able to use their services, I decided to send some money to OPay. OPay is fast oh.”

Yet another X user, @Ssaasquatch, tweeted, “Opay is heads and shoulders above everyone else. Used them once and I was more than impressed. I don’t like how overtly aggressive they are with their marketing, but I believe everyone should have an Opay account.”

Mark Essien, co-founder of Hotels.ng., tweeted, “Opay and Moniepoint will win the Nigeria banking game with their reliability. The other banks are going through spells of extreme unreliability. Failed transfers held for days before refund. In the meantime, people have no cash to do things with.”

Fintech Growth

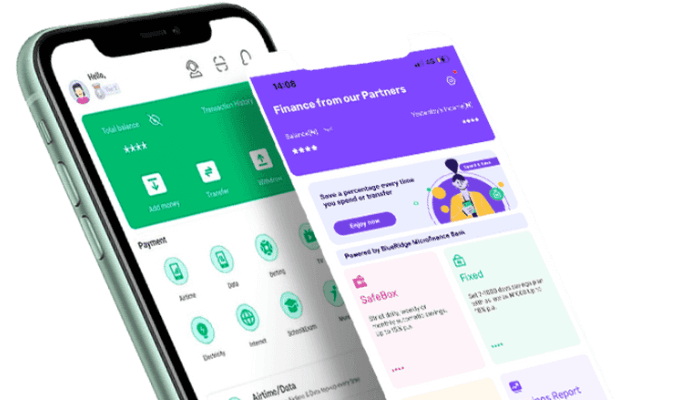

As of June 2023, OPay reported having 30 million users, attributing its success to IT investments. It explained that its agile IT network allows rapid capacity expansion, surpassing traditional banks’ capabilities.

PalmPay’s user base recently grew to 35 million, with Chika Nwosu, its managing director, stating, “Every month, we process over 300 million transactions.”

In 2023, Moniepoint averaged 433 million monthly transactions across its payment channels, dominating the point-of-sale space in the process.

Read also: Why banks’ software upgrade causes disruptions

Banks’ upgrades

Many commercial banks are upgrading their capacities to meet demand for online payments. However, many customers have had to bear the brunt of short-term frustrations in exchange for long-term benefits.

“The upgrades will improve banking capacity and cope with increased online banking demand,” said Olowe of Lendsqr, who once worked at UBA, Access Bank, Fidelity, and FCMB.

Nigeria’s electronic payments rose by 84.37 percent to N572.63 trillion in the first seven months of 2024, highlighting the country’s growing reliance on digital payments and shift away from cash dependence. Following a CBN withdrawal policy, cashless payments increased to N611.06 trillion in 2023 from N395.38 trillion in 2022.

However, this rapid rise in cashless transactions has exposed gaps in the country’s banking infrastructure. The World Bank commented that Nigeria’s transition to a cashless economy in 2023 was hindered by inadequate digital infrastructure.

In response, banks are investing heavily in their core banking infrastructure to close these gaps. Five banks plan to invest N248.21 billion in technology upgrades over the coming months. Guaranty Trust Bank (GTB) alone will spend N70 billion upgrading its core banking applications, hardware, and network architecture.

The current infrastructure upgrades are also critical to strengthening banks’ cybersecurity capabilities. Between 2019 and 2023, Nigerian bank customers lost N59.33 billion to fraud, with over 80,658 customers scammed in 2023 alone—a slight decrease from 84,130 in 2022.

Challenges in Software Migrations

“Migrating to a new core banking system is complex,” said a fintech CEO. “It involves infrastructure, software, customer channels, historical data, training, certification, and commissioning.”

However, a senior executive close to Finacle said, “Replacing a core banking application is like changing the engine of a Boeing 747 mid-flight.”

In the 2000s, First Bank took six months to migrate from Bankmaster to Finacle. A tier-one bank worker echoed, “Migrations take a lot of time. Our last major upgrade took a while as well.”

Olowe, earlier mentioned, said: “These upgrades are routine for banks globally. Large businesses must periodically upgrade their core systems.”

These improvements are essential as the banking sector gears up for growth amidst capital raises. In March 2024, the CBN announced new capital requirements, mandating international banks to increase their capital base to N500 billion, national banks to N200 billion, and regional banks to N50 billion.

In 2005, banks were mandated to increase their capital base to N25 billion. This led to many mergers and technology upgrades. For example, the merger between United Bank for Africa, Standard Trust Bank, and Continental Trust Bank into the UBA group led UBA to change its banking software to Finacle from Flexcube.

“Banks are preparing for the future,” Olowe added. “With new capital, they are ready for hyper-scale growth, supported by better platforms.