Africa’s biggest oil producer is struggling to attract investments into its energy sector whereas Suriname, a tiny South American country, is getting serious investment attention from one of the biggest oil majors in the world, TotalEnergies.

With a population of about 700,000 and less than 1 percent of Nigeria’s gross domestic product (GDP), Suriname has recently discovered significant offshore oil reserves, positioning it as a rising star in the global energy market, thanks to favourable, attractive investment conditions. Meanwhile, Nigeria has to fight off insurgents, hostile communities, and weak implementation of government fiscal and regulatory policies to win the attention of oil majors.

BusinessDay’s findings showed TotalEnergies has kept its word for a final investment decision (FID) for a more than $10 billion offshore oil and gas development in Suriname, the South American country’s first.

Located in Block 58 about 140 km offshore, the Gran Morgu field has estimated recoverable resources of 700 million barrels of oil equivalent adjacent to Exxon Mobil’s, with 11 billion-barrel find in neighbouring oil hotspot, Guyana.

Read also: Faces behind Chappal, new owners of TotalEnergies’ $860m assets

“Launched only a year after the end of appraisal, GranMorgu fits with our strategy to accelerate time-to-market and develop low-cost and low-emission oil projects,” said Patrick Pouyanné, chairman and CEO of TotalEnergies. “We look forward to continuing our fruitful collaboration with Staatsolie to deliver a transformative project for Suriname’s economy.”

Staatsolie, Suriname’s state-owned energy company and market regulator, estimates Suriname’s oil and gas resources could bring in between $16 billion and $26 billion, dwarfing the country’s $4.34 billion GDP.

The first oil on Gran Morgu is targeted for early 2028 using a floating production, storage and offloading vessel capable of processing 200,000 barrels of oil per day.

For TotalEnergies, the Suriname project is part of its strategy to focus on low-cost, low-emissions upstream oil projects.

The oil will be produced for under $20 per barrel, Pouyanne has said, while expecting the company’s emissions cap of 18 kg of CO2-equivalent per barrel of oil equivalent on new projects.

Earlier this year TotalEnergies took FIDs on offshore fields in Angola and Brazil, and is pursuing the development of major discoveries in Namibia.

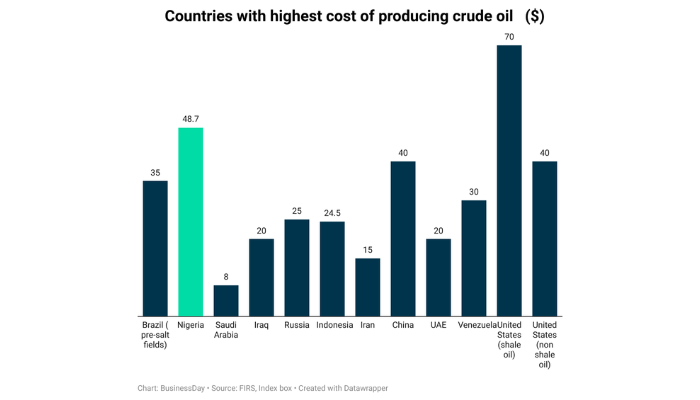

Suriname’s gain is Nigeria’s loss as BusinessDay’s findings showed It is much cheaper to produce crude oil in war-torn Iraq, Saudi Arabia and Iran than in Nigeria, Africa’s biggest oil producer.

A BusinessDay survey showed the cost of oil production per barrel of $48.71 ranks Nigeria among the countries with the highest cost of producing crude oil globally.

For instance, Saudi Arabia has some of the lowest production costs in the world, with estimates ranging from $2 to $8 per barrel. The country benefits from vast oil fields and low extraction costs.

Iran has relatively low production costs, estimated to be around $10 to $15 per barrel. However, the country has faced challenges due to economic sanctions.

Brazil’s pre-salt oil costs roughly $35/barrel to produce, according to Schreiner Parker at consultancy firm, Rystad Energy,

The cost of producing a barrel of oil in the United States varies depending on the region. On average, shale oil production costs range from $35 to $70 per barrel, while conventional oil production costs range from $20 to $40 per barrel.

Russia’s production costs range from $15 to $25 per barrel. The country benefits from large reserves and an extensive pipeline infrastructure.

China’s production costs are estimated to be around $35 to $40 per barrel. The country has experienced growth in oil production but faces challenges related to its geology and aging fields.

Read also: Chappal acquires TotalEnergies’ stake in Nigeria’s oil assets for $860m

The cost of producing a barrel of oil in the United Arab Emirates (UAE) ranges from $10 to $20. The country has significant reserves and benefits from low extraction costs.

Iraq has low production costs, estimated to be around $10 to $20 per barrel. However, the country faces security and infrastructure challenges.

The cost of producing a barrel of oil in Venezuela ranges from $15 to $30. The country has vast reserves but struggles with political instability and aging infrastructure.

“The biggest factor for IOCs leaving Nigeria is the high cost of production they get compared with other countries like Guyana,” said Martins Agboola, an energy professional.

Security for oil assets, many operators say, has not been treated with the seriousness it deserves, considering that oil is responsible for much of the nation’s revenue. Militants routinely kidnap oil workers, especially expatriates, and sabotage of oil pipelines occurs too frequently to absolve government officials including security personnel of collusion with criminals.

Mele Kyari, group CEO of Nigerian National Petroleum Company (NNPC) Ltd, blamed the high average cost of production per barrel on insecurity and other sundry issues.

“Security means everything to the oil and gas sector. Insecurity doesn’t stop the oil and gas industry from operating. They (oil companies) operate in Afghanistan, any country that you know there are conflicts. But what it does is that it adds a premium to the cost of production,” Kyari said as a guest speaker during the 2024 Faculty of Science lecture at the Obafemi Awolowo University, Ile-Ife.

Nigeria is Africa’s largest oil producer, but frequent incidents of sabotage and oil theft have hindered the sector onshore.

Many newer projects are focused offshore, where production is more secure but the capital investment required is higher.