The yr 2023 proved to be one other rollercoaster yr for Nigerian fixed-income markets. Certainly, the yr was going to be one other inflexion level as the overall elections marked the tip of the eight-year presidency of Muhammadu Buhari.

The incoming Tinubu administration moved to alter issues rapidly with massive will increase in petrol costs, the dismissal of the erstwhile CBN governor (Godwin Emefiele) and the removing of the exhausting peg on Naira buying and selling throughout the official FX market, which led to a 40% weakening of the foreign money in June.

Within the months that adopted, the Naira would lose over 57% of its worth in nominal phrases (round 20% in actual phrases) to submit its worst yr since 1995 and inflation would speed up to twenty-eight%, the very best since 2005.

When it comes to mounted earnings markets, charges throughout the Naira yield curve climbed on common round 128bps in 2023, pushed by sell-offs throughout the whole curve: front-end (+175bps), center (+80bps), and long-end (+170bps).

The lift-off in charges was pushed by a robust repricing on the one-year +350bps) which adopted the sale of OMO invoice gross sales by the CBN at yields of 20-21% starting in Q3 2023.

Nonetheless, yields retraced strongly in December with the 1-yr buying and selling at efficient yields of 12-13% after rising to 17.5% ranges in November reflecting a pull-back in CBN liquidity administration and because the Debt Administration Workplace closed out its 2023 borrowing cycle after reaching its targets in early December.

From a value perspective, whole returns on Nigerian bonds utilizing the S&P/FMDQ bond index got here in at 8.1% (2022: 7.8%) with many of the value positive factors concentrated in December.

Determine 1: Naira Yield Curve

Supply: Bloomberg

• Regardless of coverage tightening, Naira depreciation drives above-target growth in cash provide: financial aggregates, out there information by way of September reveals robust development in Broad Cash (M3) (+38.4%, annualized) relative to CBN’s goal of 28% (2022: +19%) regardless of the pursuit of contractionary financial coverage.

If something, the tightening stance over H2 2023 merely helped dampen the strong tempo of financial growth within the first half of the yr when M3 expanded as excessive as 49% in June 2023.

The speedy enhance in cash provide displays a surge in web home belongings, NDA (up 52%, annualized), relative to a contraction in web overseas belongings, NFA (down 86%).

The expansion in NDA largely mirrored robust credit score development throughout the general public sector (+51% annualized to NGN34.1trillion) and personal sector (+54% to NGN58.6trillion) pushed by the report fiscal deficits within the former and the interpretation impression of the NGN depreciation on USD loans within the latter.

Regardless of stronger oil costs and enhancing oil manufacturing, the steep declines in web overseas belongings relative to extra modest declines (down 12% to USD32.8billion) in Nigeria’s FX reserves displays the large overhang of exterior overseas liabilities comprising giant cross-currency swaps (USD21billion) and USD forwards (USD7billion).

The growth in cash provide comes within the face of upper direct liquidity sterilization through CRR debits as cumulative CRR money owed stood at NGN16.7 trillion on the finish of September 2023, up from NGN13 trillion on the finish of 2022.

• CBN returns to liquidity sterilization however steadiness sheet issues complicate efficacy of tightening measures: When it comes to precise securities provide, after three years of lowering the dimensions of its ‘public’ Open Market Operations (OMO) invoice portfolio, the CBN returned to energetic liquidity administration with web issuance of OMO invoice to the tune of NGN658billion which compares with the sample of enormous redemptions within the prior three years (2022: NGN1.3trillion, 2021: NGN4.5trillion and NGN6.03trillion in 2020) which left the full excellent inventory of public OMO payments at NGN1.2 trillion, the bottom stage in 9 years.

I exploit the excellence between private and non-private OMO payments as following the discharge of the long-delayed CBN audited financials, it was revealed that the CBN had a a lot bigger OMO invoice inventory (NGN10trillion) which displays off-market OMO payments issued to banks and different counterparties as an alternative of the well-known cross foreign money swaps.

The massive liabilities operating at elevated rates of interest seem to have been the principle confounding issue to efficient financial coverage because the related prices raised the chance that the CBN would run a loss.

As I flagged in my word on Nigeria’s central banking, that is the principle downside to asset-driven central banks as efficient sterilization of extra liquidity required a profitability trade-off which underpinned CBN’s desire for reserve necessities as the important thing instrument for financial coverage.

How the CBN navigates this trade-off, in my opinion, will probably be key in viewing coverage credibility over 2024.

• This leaves elevated authorities borrowings as the principle driver of upper yields: The comparatively tame CBN liquidity sterilization implied that one thing else pushed Nigerian yields to report ranges in September-November 2023.

For my part, this displays a return to aggressive borrowing by the DMO late within the yr with a ramp-up in gross sales of Nigerian Treasury Payments (NTBs) the place gross issuance climbed to NGN5.8 trillion (in comparison with NGN4.7 trillion in 2022).

Adjusted for maturities, the DMO successfully borrowed NGN1.3 trillion largely over November 2023 reflecting a want to hit borrowing targets. In the same vein, gross bond gross sales climbed 103% to a different annual report of NGN6.2 trillion, together with NGN350 billion in sukuk gross sales.

Adjusted for the April 2023 bond maturity, web bond gross sales have been a report NGN5.5 trillion (in comparison with NGN2.6 trillion in 2022).

Some extent to notice is that these borrowings have been largely financed by home traders which speaks to the understated depth and scale of Nigeria’s native debt markets.

In step with rising rate of interest tendencies, the common cease charges on bond gross sales throughout 2023 climbed to fifteen.3% in comparison with 13.05% in 2022.

Nonetheless, regardless of the rise in nominal yields, the acceleration in inflation signifies that NGN bond yields stay costly, given the persistence of wider destructive actual yields (-1273bps in comparison with -760bps on the finish of 2022).

Determine 2: Financial coverage and market rates of interest

Supply: CBN, FMDQ

• Fiscal and financial influences to drive bear flattening: Looking forward to 2024, developments throughout Nigeria’s debt markets will stay linked to lingering points within the FX market.

Financial coverage ought to stay tight to domesticate portfolio flows to bolster USD provide on one hand, whereas sterilizing Naira liquidity to curb USD demand on the opposite.

Essentially, inflation will seemingly stay elevated (25-30% area) as gas and FX shocks proceed to propagate over H1 2024, although giant base results will anchor a deceleration in the direction of 20-25% over H2 2024.

• Whereas the CBN ought to stay hawkish, as I famous in my piece on Nigerian central banking, the important thing query for an asset-driven central financial institution just like the CBN is easy methods to credibly sterilize liquidity with out operating unsustainable losses.

To credibly sign to fixed-income markets that it needs Naira rates of interest to stay elevated, the CBN should primarily sterilize ALL extra liquidity from the banking system.

There are three means to hold out this successfully: elevated open market operations (OMO) payments (probably at >20% charges), aggressive hikes within the MPR which increase the SDF (effectively above 20%) or scorching increments in money reserve necessities in the direction of 50%.

The issue with the primary two approaches is that CBN’s giant personal OMO invoice securities issued as the other leg of its cross-currency swaps to Nigerian banks have tremendously constrained its steadiness sheet.

Thus, the seemingly desire is for low-cost liquidity administration choices. This results in my guess that the alternatives going through the CBN are to both ramp up the size of advert hoc CRR debits or return to the Sanusi-era public CRR at a excessive stage (75-80%).

Something absence of this or aggressive hikes in OMO exercise and low cost window charges will lead to non-credible liquidity administration.

As we noticed in December, this can result in declines in charges when the CBN turns passive to any build-up in system liquidity.

General, I believe the CBN will stay in a climbing cycle over H1 2024 with potential 100-300bps will increase in coverage charges alongside a much less tolerant view on system liquidity whereby adhoc CRR will probably be deployed to repair with the occasional OMO auctions to sign price ranges.

It is a cheesy strategy however until the underlying steadiness sheet points are addressed and there are important enhancements in natural USD flows, a muddle-through liquidity tightening is what we’ll get.

On the fiscal facet, the proposed 2024 finances requires NGN6.06trillion in native borrowings which alongside refinancing of 2024 bond maturities of NGN720billion (March 2024) and huge NTB refinancings of NGN6.2trillion speaks to a probably heavy fiscal securities issuance over the yr.

The closure of the W&M financing utilized by the prior Buhari administration means that these borrowings stay market-driven.

You will need to make clear that the latest securitization of a further NGN7 trillion in Methods & Means wraps up the legacy Buhari period overdrafts. Utilizing CBN information by way of June 2023, W&M overdrafts stood at NGN30trillion on the finish of Might 2023 implying that the latest transfer displays the excellent portion and never new securitizations.

Within the common method, FGN borrowings are prone to be front-loaded given the big maturity in March. When it comes to goal bond tenors for 2024, the debt borrowing plans are prone to stay centered on 4-bonds on supply with re-openings alongside the 5-year, (FGN 2031), 10-year (FGN 2033), 15-year (FGN 2038), a possible return to the 25-year bucket through a brand new bond (FGN 2044) and the withdrawal of the 30-yr bond which markets seem like pricing given the response within the 2053s following the December public sale.

Determine 3: Nigeria’s Annual FGN Bond Maturity Profile (NGN’bn)

Supply: FMDQ

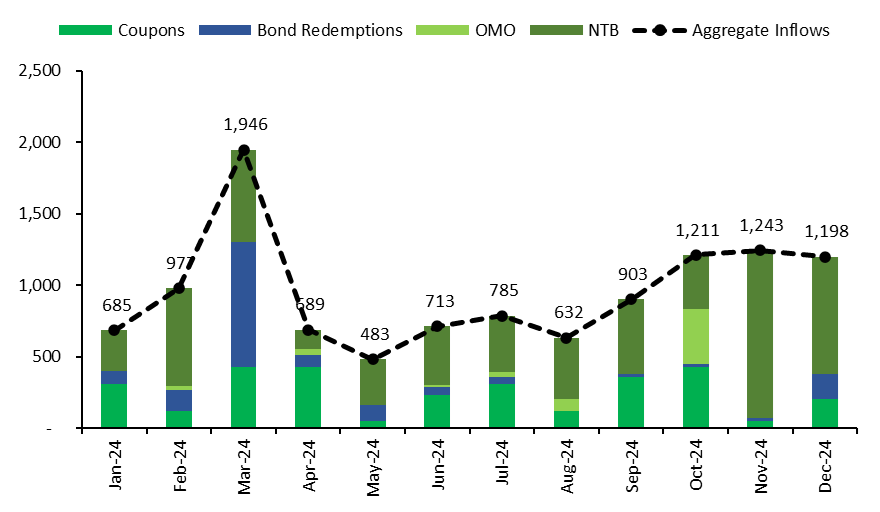

When it comes to potential liquidity flows, I estimate that month-to-month maturities (together with Bond coupons, OMO and NTB) over 2024 will common NGN955billion (vs NGN676billion in 2023, NGN620billion in 2022 and NGN720billion in 2021).

On the provision facet, my guess is that month-to-month securities provide (incorporating the FGN debt plans and NTB/OMO refinancings) will seemingly common NGN1.2 trillion (2023: NGN826 billion) which exceeds system maturities. On steadiness, my sense is that there will probably be an extra of securities provide over potential demand for paper which is essentially supportive of upper rates of interest over 2024.

How excessive charges go will probably be decided by the interaction between how hawkish the CBN approaches extra liquidity in making an attempt to sign increased charges (seemingly in H1 2024) and the way determined the DMO is to fulfill its FGN borrowing goal.

This implies related bearish situations when any overlap happens corresponding to over Q2-Q3 2024 in a reprisal of the September-November 2023. General, a bear flattening over the yr is my name.

Determine 4: Maturity profile over 2024 (NGN’ million)

Supply: CBN, FMDQ

If you want to obtain this each week in addition to different posts or you already know somebody who will discover the knowledge on this website helpful, you possibly can add your e-mail utilizing the subscribe button beneath