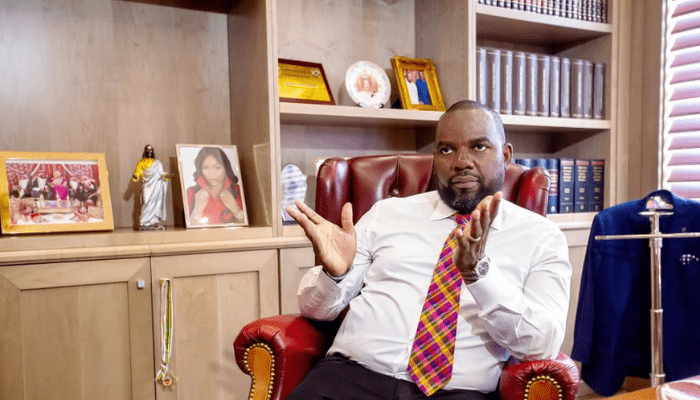

Julius Rone stands at the forefront of Nigeria’s energy sector as the CEO of UTM Offshore, a company spearheading the development of the country’s inaugural floating liquefied natural gas (LNG) facility.

BusinessDay’s findings showed UTM Offshore’s FLNG project will unlock a new era of LNG industry growth in Nigeria and across the region as energy demand continues to increase.

This ambitious project marks a significant milestone in Nigeria’s quest to enhance energy infrastructure and solidify its position as a key player in the global LNG market.

Profile of Rone

Rone is a seasoned administrator and industrialist with vast experience spanning over a decade in both the public and private sectors of the Nigerian economy, as a major player in the oil and gas space.

He worked as a protocol assistant at the Oil Mineral Producing Areas Development Commission (OMPADEC) from 1995 to 2000, and from 2000 to 2008, he worked with the Niger Delta Development Commission (NDDC) as the protocol assistant to the Chairman.

Since 2008, he has been the group managing director of the UTM Group of Companies. Rone came on board as Charge De’ Affairs of the UTM Group of companies, viz., UTM Offshore Limited, UTM FLNG Limited, and UTM Energy Limited.

Also, he worked with UTM Dredging Limited, UTM Engineering and Construction Limited, UTM Properties Limited, UTM Logistics and Marine Services Limited, MWS Allied Services Limited, Water Petroleum Limited, SBM Limited, UTM Ghana Limited, and UTM-CTK Ghana Limited.

In 1986, Rone received his first school leaving certificate from Mowoe Primary School, Warri, Delta State. He then proceeded to Uwangue College, Warri, Delta State, where he obtained his senior school leaving certificate in 1992.

He is an alumnus of Obafemi Awolowo University, Ile-Ife, and the University of Calabar, where he attained his advanced diploma and postgraduate diploma in business administration, respectively.

Rone holds membership portfolios in the Institute of Directors (IoD), American Society of Administrative Professionals (ASAP), American Management Association (AMA), International Association of Administrative Professionals (IAAP), USA, and Association of Associate Executives (AAE), among others.

The business mogul was born on June 25, 1968, into the family of Chief S. S. Rone, the Obazuaye of Warri Kingdom, in Delta State, Nigeria.

Read also: UTM Offshore CEO, Julius Rone, wins award for pioneering FLNG in Africa

UTM Offshore

State-owned oil company Nigerian National Petroleum (NNPC) entered into an agreement with UTM Offshore to purchase a 20 percent equity stake in the project in July 2023.

In December 2023, UTM Offshore, the Delta State Government, and NNPCL signed a shareholder agreement to jointly develop the project.

The project will be owned by UTM FLNG (72 percent), a special-purpose vehicle formed for the development of the project by UTM Offshore, NNPC (20 percent), and Delta State Government (8 percent).

The project is expected to produce 1.5 million metric tonnes per year of liquified natural gas (LNG) for export markets, 300,000 metric tonnes of LPG a year for domestic consumption, and some quantities of condensate.

Location details

The UTM FLNG facility is being developed at the Yoho field at a water depth of 64 m.

The Yoho field is situated within oil mining lease (OML) 104, approximately 60 km from shore. It is owned by ExxonMobil (40 percent, operator) and NNPC (60 percent) and commenced production in 2003.

The project will have access to 2.2 trillion cubic feet of proven gas reserves from OML 104 for 20 years.

UTM FLNG development details

UTM Offshore obtained the licence to establish the FLNG project from the Department of Petroleum Resources in February 2021. The project is planned to be developed in two phases.

The FLNG facility will include a turret and mooring system, gas pretreatment modules, LNG production modules, an accommodation facility, self-contained power generation, and utilities, as well as provision for LNG storage and offloading.

The LPG produced from the FLNG will be supplied to the domestic market, and the LNG produced will be offloaded into LNG carriers for further transportation.

Vitol Gas, an energy and commodities company, is a potential LNG buyer for the project.

Financing

UTM Offshore entered into a memorandum of understanding with African Export-Import Bank (Afreximbank), a pan-African multilateral financial institution, to serve as the lead financier of the project in December 2021.

Subsequently, Afreximbank raised $2bn for the first phase of development, with a commitment of $3bn for phase two.

Contractors involved

JGC Holdings, an engineering design, procurement, and construction company, along with Technip Energies, an energy technology company, and Kellogg Brown and Root (KBR), a technology company, were contracted to provide the front-end engineering and design (FEED) services for the project in November 2022.

JGC will oversee the topside LNG production facility design, while Technip Energies will be responsible for the hull and the mooring system design.

JGC was previously contracted to perform the pre-FEED design for the FLNG facility in May 2021. KBR served as the owner’s engineer and conducted a due diligence review of the pre-FEED design. Yahaska Energy, a consulting company, provided overall project development management services.

Richflood International was chosen to perform an environmental and social impact assessment for the project in July 2022.

Templars, a law company, acted as a project counsellor in securing the licence for the development of the project.

Project benefits

The UTM FLNG project is in line with the Nigerian government’s vision of promoting the utilisation of domestic gas resources. The country has more than 200 trillion cubic feet of proven gas reserves.

The FLNG will supply 25 percent of Nigeria’s domestic LPG demand. It will provide LPG at lower costs and increase access to the fuel, thereby providing clean cooking solutions in the country.

The project is expected to generate 3,000 direct and 4,000 indirect employment opportunities in Nigeria.