Nigeria’s electricity sector has been haemorrhaging funds for over a decade, with N6 trillion gulped down by subsidies in the past ten years.

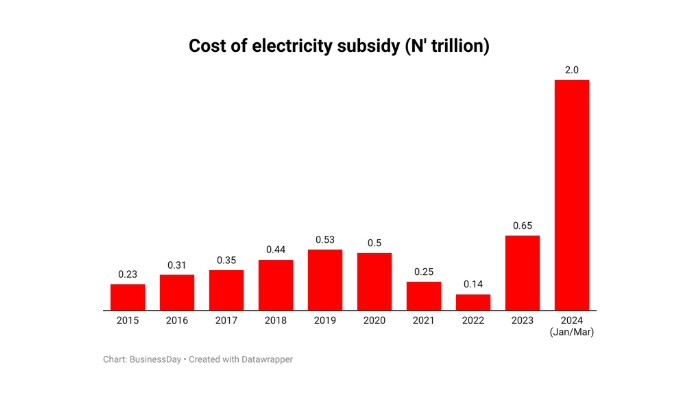

Data from the Nigeria Electricity Regulatory Commission (NERC) revealed that the government paid N645 billion in 2023 from N225 billion in 2015 for subsidies, signalling a spike of 186.7 percent.

In the first two months of 2024, the electricity subsidy bills have gulped N267 billion.

Findings showed the federal government would pay N1.67 trillion as electricity subsidy in 2024, even though the Nigerian Bulk Electricity Trading Plc budget only showed a subsidy plan of N450 billion.

The 2024 electricity subsidy is 170 percent higher than the N619 billion reportedly paid last year, according to findings by BusinessDay.

Further breakdown showed the customers of Ikeja DisCo will benefit the most from the plan, with around N238 billion earmarked as subsidies, up from N77.41 billion reportedly paid in 2023. This is closely followed by the Abuja Electricity Distribution Company (AEDC), which is projected to receive around N233 billion as an electricity subsidy.

Yola Electricity DisCo has the least amount of subsidy, with N64.48 billion earmarked as opposed to N45.95 billion reportedly paid as subsidy in 2023.

Analysts said the problem with that plan is its lack of viability and that it may be the starting point for another expensive subsidy.

“The rich, accounting for only 20 percent of electricity consumers, are reaping more significant rewards from subsidies than the intended beneficiaries,” said Adetayo Adegbemle, convener and executive director of PowerUp Nigeria, a power consumer advocacy group.

He said the electricity subsidy in Nigeria has become a financial burden that “is no longer sustainable”.

“Urgent action is needed to address the disparities in subsidy distribution, prevent further strain on government finances, and redirect resources to areas where they can have a more significant impact,” he added.

Adeola Adenikinju, a professor of energy economics and president of the Nigerian Economic Society, said introducing the N1.67 trillion electricity subsidy won’t solve the challenges in the power sector.

“The Central Bank of Nigeria and the federal government had poured trillions naira into the power sector with little or nothing to show for it; so I don’t see the N1.67 trillion electricity subsidy solving access to electricity; rather, it will worsen the government’s fiscal balance,” he said.

According to him, some of the long-term solutions include addressing the issues of technical losses and implementation of market-driven tariffs.

“Otherwise, all investment will be wasted,” Adenikinju added.

Lekan Ademola, a Lagos-based asset manager, said Nigeria is living above its means, adding that the N1.67 trillion electricity subsidy will place a significant strain on the already stretched budget of the federal government.

“The government is essentially borrowing to pay for electricity. This will only increase our debt burden and make it even harder to balance the budget in the future,” he said.

According to the budget document, the 2024 budget deficit represents 3.9 percent of GDP, and the government is betting on debts (N7.83 trillion) and proceeds of privatisation (N298.49 billion), and a drawdown on multilateral and bilateral loans secured for specific development projects (N1.05 trillion) to finance the deficit.

“While the N1.67 trillion electricity subsidy may provide temporary relief to consumers, it puts immense pressure on the government’s ability to fund critical infrastructure and social services. The potential for larger deficits could deter foreign investment and further weaken the naira,” Ademola said.

Last August, the federal government said it had spent about N7 trillion as direct interventions in the power sector despite privatising the electricity generation and distribution companies in November 2013.

“The federal government has spent about N7 trillion on interventions, direct interventions. I am not talking about monies from donors, but on direct interventions, and we are also asking for more,” Edmund Eje, market operator of the government-owned Transmission Company of Nigeria, said at a briefing in Abuja.