In Northern Nigeria, where cultural and economic structures have traditionally limited women’s financial independence, a powerful new tool is helping change the landscape of opportunity for female farmers: livestock insurance.

By offering security and economic resilience, livestock insurance allows more Northern Nigerian women to enter and succeed in agriculture, improving their livelihoods, supporting their families, and bolstering the country’s economy.

While this is a promising development, challenges remain around awareness, accessibility, and financial literacy. As more women embrace the potential of livestock insurance, both policymakers and insurers have a significant role to play in ensuring these efforts reach their fullest potential.

Role of Northern women in the livestock industry

In Northern Nigeria, women play a crucial role in the livestock industry, contributing significantly to rural economies and providing essential support to their families.

While cultural norms often limit women’s access to land, livestock farming is a viable and often accepted source of income for women in this region. This industry not only bolsters household incomes but also fosters greater economic stability within communities.

However, despite their contributions, female livestock farmers face unique challenges that hinder their potential and limit their overall impact on Nigeria’s agricultural sector. Women in Northern Nigeria have long been involved in the rearing of cattle, goats, sheep, and poultry. Their activities encompass dairy production, breeding, and the sale of livestock products such as milk, eggs, and meat, which constitute essential sources of protein for local diets.

According to the Federal Ministry of Agriculture and Rural Development, women represent about 40 per cent of Nigeria’s livestock farmers, with Northern Nigeria being a primary area of engagement. Additionally, the Food and Agriculture Organisation highlights that women in developing countries contribute around 60 to 80 per cent of food production activities, with livestock farming forming a considerable part of this output.

By managing livestock assets, women gain a measure of economic autonomy, allowing them to support household needs, pay for children’s education, and make healthcare contributions.

In many communities, livestock is seen as a more accessible form of wealth than land, enabling women to generate a steady income stream without confronting the cultural and legal obstacles associated with land ownership.

Economic impact of female livestock farmers in Nigeria

The economic impact of women’s involvement in livestock farming is substantial. In 2022, Nigeria’s livestock sector contributed about six per cent to the country’s Gross Domestic Product, with female farmers responsible for a significant portion of this output.

Dr Usman Musa, a Nigerian agricultural researcher based in Germany, stated that Northern women play a key role in ensuring food security by providing fresh dairy products, meat, and animal by-products that supply local markets.

“Their contributions, while often informal and underreported, are essential to the economic well-being of rural communities and critical to Nigeria’s overall agricultural economy,” he added.

A study by the International Livestock Research Institute found that, in Nigeria, women who engage in livestock farming are 25 per cent more likely to contribute positively to household food security than those who do not, underscoring the pivotal role livestock plays in sustaining both family incomes and local food systems.

However, while their impact is large, these women often do not receive the necessary support, limiting their productivity and the economic benefits they could potentially bring to the sector.

Despite their critical contributions, Northern Nigerian women in livestock farming face numerous challenges, including limited access to resources, financing, technical support, and insurance.

“The lack of credit facilities is a persistent barrier, as women in rural areas are less likely to own assets like land that could be used as collateral for loans. This financial constraint hampers their ability to expand operations, invest in quality animal feed, or secure veterinary services for their livestock,” Musa added.

Disease and poor animal health are other significant challenges. Many female farmers lack access to modern veterinary services, which increases the risk of livestock loss due to common diseases. This issue is compounded by a lack of awareness about proper livestock management practices, as most training programs are targeted at male farmers, leaving women with fewer resources to improve their productivity.

A report by the African Union Inter-African Bureau for Animal Resources noted that 70 per cent of rural women in Northern Nigeria had little to no access to extension services or veterinary support, greatly limiting their ability to maximize their contributions to the livestock sector.

Furthermore, climate change has intensified challenges for these women. As droughts and other climate-related events become more frequent, female farmers struggle with pasture scarcity, water shortages, and reduced livestock productivity.

A 2021 report by the World Bank observed that livestock-reliant communities in Nigeria’s Northern region faced increasing difficulty due to environmental degradation, and women were often the most affected due to their limited mobility and resources.

Livestock insurance

Livestock insurance in Nigeria has emerged as a crucial solution for protecting farmers, particularly in the northern regions, against the financial risks associated with livestock farming.

The sector aims to provide insurance coverage for losses due to disease, theft, and natural disasters like floods and drought, which are increasingly common due to climate change. This financial safety net helps mitigate the impact of such losses on farmers’ livelihoods, enabling them to rebuild more quickly without falling into debilitating debt or poverty.

Despite its importance, livestock insurance is still underdeveloped and limited in coverage across the country.

The Nigerian Agricultural Insurance Corporation is the primary provider of such insurance, working to extend its reach to rural farmers, often in partnership with private insurers and government initiatives. However, many small-scale farmers remain unaware of available insurance options or lack the financial means to pay the premiums.

To address this, some insurance providers are offering micro-insurance products with lower premiums, aiming to make coverage more accessible for smallholder farmers, particularly women who play a vital role in livestock farming across Northern Nigeria.

One major challenge in the sector is low penetration due to logistical barriers and the informal nature of much of Nigeria’s agricultural sector. Insurers often struggle with accurately assessing risks in remote areas where veterinary services and data on livestock health are scarce. Moreover, research has shown that limited government funding and support for this type of insurance affect its growth, leaving many farmers exposed to significant risks.

With ongoing efforts to expand livestock insurance through digital platforms and mobile payments, there is potential for growth.

However, for the sector to thrive, experts have noted that increased public awareness, improved rural infrastructure, and robust policy support are essential to making livestock insurance a staple of Nigeria’s agricultural economy.

What’s in it for Northern women?

The benefits of livestock insurance for women go beyond immediate financial protection; they extend to broader economic empowerment. Experts have noted that when women know their livestock is insured, they are more likely to invest in additional animals, diversify their herds, and expand their business operations.

This creates a positive cycle: increased investment in livestock farming leads to greater income, more savings, and ultimately, more secure financial footing for their households.

This financial independence can have a ripple effect, not only on their families but also on their communities. Women are known to reinvest a significant portion of their income into family welfare, education, and community improvements, making them powerful agents of change.

Female livestock farmers making an impact

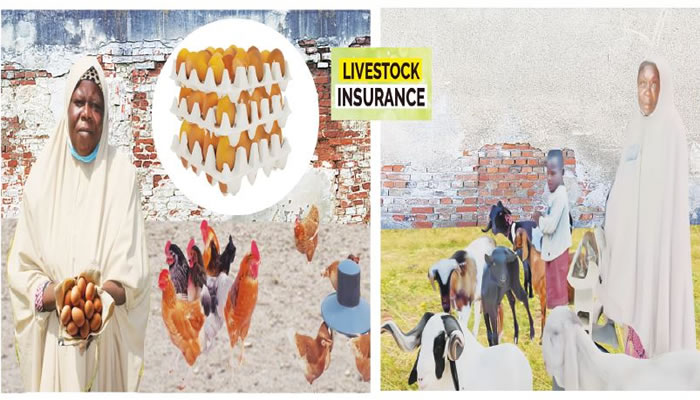

Several real-life examples highlight the resilience of Northern Nigerian women who are making significant strides in livestock farming, despite facing economic and security challenges.

One such story is Amina Abdullahi from Kano State. Amina has become a prominent figure in her community by managing a small herd of goats and cattle.

Despite facing limited access to veterinary services, especially during the dry season when water and feed are scarce, she continues to support her children’s education by selling dairy products in the local market.

“I started this farm with just one small corner kiosk, but now I have several others and a few women who work for me,” she shared in a recent phone conversation.

Amina was able to secure livestock insurance for her farm through the assistance of her husband, who is also a livestock farmer.

Another woman making strides in the livestock business is Hadiza Usman from Zamfara State. Hadiza, a widowed mother of five, took up livestock farming after her husband’s death to provide for her family. She raises poultry and a few cows, which are herded by her young sons. However, ongoing security concerns and high veterinary costs have limited her ability to expand her market reach and led to frequent livestock losses.

Despite these barriers, Hadiza’s determination enables her to meet her family’s needs, showcasing how Northern Nigerian women persist despite security challenges and economic uncertainty.

Challenges in accessing livestock insurance

Despite the clear benefits, accessing livestock insurance remains difficult for many women in Northern Nigeria. Limited awareness and financial literacy hinder many from understanding the benefits of insurance or knowing how to access it.

In some cases, logistical and cultural barriers further complicate the adoption of livestock insurance in rural areas.

Many female farmers also face challenges with the cost of premiums and lack the support needed to navigate the insurance process effectively.

Even for those who are aware, physical and financial access to insurance services can be challenging due to the scarcity of banks and insurance providers in rural areas. In regions where women face mobility restrictions, travelling to an insurance office is often not an option, further limiting their ability to secure coverage.

The Nigerian Agricultural Insurance Corporation has stated that it has been working to address some of these barriers by offering educational programmes and workshops aimed at educating rural women on the basics of livestock insurance.

Additionally, NGOs like the Women Farmers Advancement Network have been instrumental in spreading awareness and creating cooperatives that pool resources for collective insurance coverage. This cooperative model reduces the cost burden for individual farmers and increases access to insurance, helping more women safeguard their livelihoods.

Bridging the gap

While progress is being made, there is a need for continued efforts to make livestock insurance more accessible and affordable for Northern Nigerian women. One key area for improvement is policy support. The Nigerian government’s Livestock Transformation Plan, if implemented with a focus on inclusivity, could encourage insurance providers to expand their services to rural and underserved areas.

Subsidies or low-interest loan programmes, specifically targeting female farmers could also help more women afford insurance coverage.

Partnerships with local cooperatives and NGOs can further bridge the gap.

The Women in Agriculture and Youth Empowerment Foundation has partnered with insurance companies to offer livestock insurance to women farmers, ensuring that more women are covered against risks that threaten their livelihoods.

Digital solutions, such as mobile-based insurance services, could also play a role in making livestock insurance more accessible. Mobile payment platforms, which are already widely used in parts of Nigeria, could make it easier for women to pay premiums and receive claim payouts, even in remote areas.

Building resilient communities

Economist and agricultural insurance expert, Mr Alade Suleiman, stated that the impact of livestock insurance extends beyond individual financial security; it strengthens entire communities.

He said, “Healthy, thriving livestock populations contribute to food security through milk and meat production. Women who are able to sustain their livestock enterprises provide nutritious food for their families and communities, creating a buffer against malnutrition and food scarcity.

“Furthermore, as more women become financially independent, they gain greater agency within their families and communities, helping to shift cultural norms and promote gender equality,” he added. Suleiman also emphasized that livestock insurance has proven to be a game-changer for Northern Nigerian women, empowering them to overcome cultural, financial, and environmental barriers.

“However, to ensure that more women can access these benefits, it is essential for the government, insurance providers, and community organizations to work together to expand awareness and access. By prioritizing inclusive policy reform, enhancing financial literacy, and developing innovative delivery models, Nigeria can help more women farmers build resilient, thriving livestock businesses that support their families and strengthen their communities.”

Ultimately, livestock insurance is not just a tool for economic security; it fosters resilience, empowerment, and sustainable development in Nigeria’s agricultural sector.

For the women of Northern Nigeria, livestock insurance offers a pathway to economic independence and a brighter future for their families and communities.