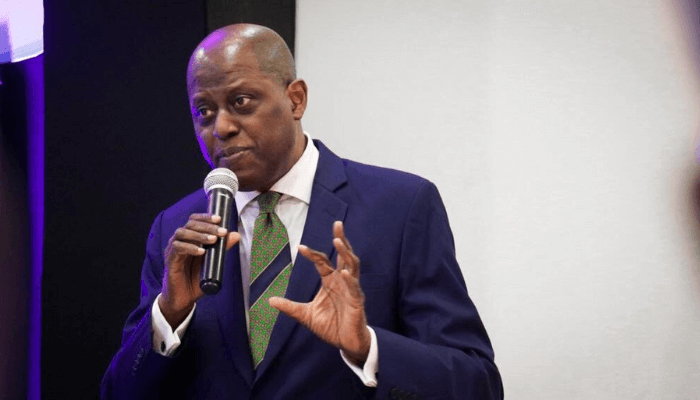

Yemi Cardoso, governor of the Central Bank of Nigeria (CBN) has revealed how the bank plans to tame inflationary pressures which are at the highest in at least 20 years.

This comes at a time when the CBN is expected to hold its bimonthly Monetary Policy Committee (MPC) meeting in February for the first time since July 2023.

Speaking in an exclusive interview with Arise TV on Monday, Cardoso said the latest International Monetary Fund (IMF) forecast is signaling a significant decline in inflation for the country this time next year or between now and the rest of the year, which is as a result of the tightening the Bank is doing.

“One is extremely sensitive to the fact that this is an issue that we as a country need to get hold of and prices do come down and become stable such that living wage is living wage,” he said.

He said the apex bank made sure that the MPC would be impactful and complement the fiscal activities to ensure it is signaling the economy in the right direction.

“The new CBN is fully focused on stabilisation of prices and lowering inflation. The MPC will reflect the new direction of the CBN focus and core mandate.”

During a meeting with the House of representatives on Tuesday, the governor also revealed that it has a target of reducing inflation to 21.4 percent.

“Inflationary pressures are expected to decrease in 2024 due to the CBN inflationary targeting policy, aiming to rein inflation to 21.4 percent aided by improved agricultural productivity and easing global supply chain pressures,” he said.

Last year was a tough one for many households in Nigeria as higher transport costs and weaker naira pushed the country’s headline inflation to 28.92 percent in December, data from the National Bureau of Statistics show.

December’s rate rose to a 20-year high for the 12th consecutive month. Food inflation which constitutes 50 percent of the inflation rate rose to 33.93 percent in December from 32.84 percent in the previous month.

While food prices in Africa’s biggest economy are rising, global prices have fallen to the lowest in nearly three years.

According to the Food and Agriculture Organisation (FAO) latest food price index report, January’s global food price index, which averaged 118.0 points, declined by one percent from December 118.5 points.

“While inflation eased in most major emerging markets, inflation in Nigeria picked up further in 2023, largely due to the removal of

the fuel subsidy in June, as well as food shortages amid adverse weather conditions and security issues in key crop-producing areas,” analysts at the Institute of International Finance said in a recent report.

“In our previous note, we highlighted that an additional 500 basis points increase in the policy rate would have helped anchor inflation expectations,” they added.

They noted that given the ongoing rise in inflation since mid-2023, “we now think there is room for a larger (750 bps) hike at the next meeting on February 25-26, which would shift the ex-post real interest rate into positive territory, keeping inflation expectations from deteriorating further.”

In a statement in December, the IMF urged the apex bank to hike the interest rates in the next meeting to address the country’s high inflation rate.

“The central bank, under its new leadership, has started to withdraw excess liquidity that was in the system, contributing to high inflation. The next MPC meeting should further raise the policy interest rate,” it said.