A new report by BDO Fintech has identified five factors that made Nigeria the most preferred destination for Africa’s fintech market.

The report examined the rapidly evolving fintech landscape across Northern, Eastern, Southern, and Western Africa and highlighted countries such as Egypt, Kenya, South Africa, and Nigeria.

Nigeria is home to some of Africa’s most successful and innovative ventures. The country is also considered one of Africa’s “Big 3” Fintech markets.

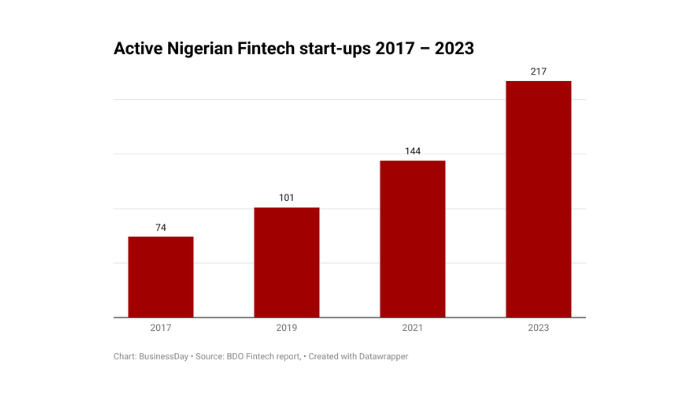

“Out of 678 fintechs startups in 2023, 217 of them are from Nigeria which equates to 32 percent. This is why Nigeria can be seen as Africa’s Fintech hotspot. This is up 50.1 percent on 144 in 2021, which had in turn been up from 101 in 2019 and 74 in 2017,” it said.

South Africa followed with 20.6 percent and Kenya with 15 percent. Africa’s fintech market is projected to grow 13-fold to $65 billion by 2030.

The report analysed that one of Nigeria’s fintech successes is its large market. It highlighted that the country’s young population of more than 200 million inhabitants makes it easier for fintech companies to deliver their solutions entirely online or through the help of a digital device because this young population is more comfortable with using digital devices and services.

Read also: Digital lending space gets N1bn liquidity boost from fintech

“Nigeria boasts an estimated 109 million internet users, and it is projected that by 2027, nearly half of the country’s internet users will access it via mobile devices. As buy now pay later solutions gain traction, this figure is expected to continue its upward trajectory. Additionally, there are over 187 million mobile connections, which is almost 90 percent of Nigeria’s population,” it said.

The report also highlighted that over $1.5 billion has been invested in Nigeria across 257 rounds since January 2015, far more than anywhere else in Africa. Similarly, Nigeria remains the frontrunner in Africa’s fintech sector, accounting for 44 percent of the total fintech funding raised across Africa in the first half of 2024, according to a new report by FutureMaters.

The report on the State of Fintech in Africa: First Half 2024 disclosed that despite an overall decline in investment across the continent’s fintech sector, Nigeria accounted for 44 percent of the total fintech funding, followed by Cote d’Ivoire with 21 percent, and South Africa with 11 percent, Egypt with 11 percent, while Ghana and Seychelles accounted for 8 percent and 5 percent, respectively.

The authors of the BDO Fintech report revealed that this has helped several unicorns (companies that achieve a valuation of over $1 billion), such as Interswitch, Flutterwave, Opay, and Esusu.

“The investments and funding that Fintechs have been receiving have created an economic ripple. As of 2022, the financial services sector contributed 5 percent to Nigeria’s GDP from 3 percent 5 years ago. This highlights the role Fintechs have played as a major driver of the growth of the sub-sector,” the report said.

BDO Fintech also highlighted that Nigeria’s success in the fintech market hinges on a robust ecosystem to support innovation, such as the rising usage of insurance and buy now pay later (BNPL), as only 3 percent of Nigerians own a credit card.

On the other hand, there is an increasing appetite for online purchases as many Nigerians are now more comfortable with online shopping.

“This has created a gap for Fintechs to capitalise on, such as the BNPL models. Whether it’s a payment or lending infrastructure, fintech start-ups help eCommerce to thrive, and with experts predicting online shoppers to reach 122 million by 2025, there is a huge opportunity for Fintech start-ups to latch onto,” BDO fintech disclosed.

It said this has opened the door to using cryptocurrencies as a form of payment. Despite the ban on cryptocurrencies, Nigeria, through the Securities and Exchange Commission (SEC), has officially granted operational approvals to several crypto operators, indicating an acceptance of the digital currency.

The approved firms include Busha Digital Limited, Quidax Technologies Limited, Trovotech Ltd, Wrapped CBDC Ltd, HousingExhange.NG Ltd, Dream City Capital, and Blockvault Custodian Ltd.

“Crypto remains popular with at least 33.4 million Nigerians aged 18 to 60 who have invested in digital assets in the past six months,” it added.