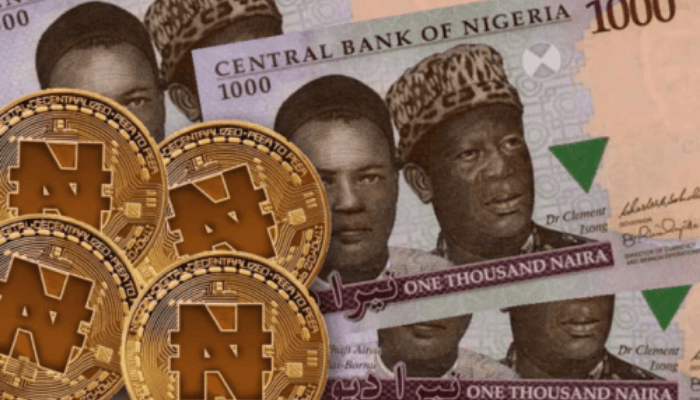

cNGN, the stablecoin the Central Bank of Nigeria (CBN) is pushing through commercial banks and fintech companies, may still have a few weeks before going to the market, but it is already facing a mountain, especially from its predecessor, the eNaira.

The CBN under the current governor, Olayemi Cardoso, has yet to announce the retirement of the eNaira but experts who believe there is no future for the central bank digital currency, say the eNaira will be eased out of the system and its place taken by the cNGN.

The promoters of cNGN including Access Bank, Providus Bank, Sterling Bank, First Bank, and a few fintech companies, are keen to not associate the stablecoin with the eNaira, launched by the Godwin Emefiele-led CBN. But try as they may, the ghost of the eNaira would not be that easy to shake off, according to experts. This is evident in most of the responses that trailed the disclosure from the government on the stablecoin.

Many features separate the cNGN from the eNaira. To start with, while the previous governor of the CBN ensured the financial regulator bankrolled the expenses for the eNaira, the consortium driving the cNGN may be required to contribute to the funding of the project. A source close to the project told BusinessDay that the consortium had yet to finalise how the project will be funded but it is likely the government will be expected to provide some level of financial support as well as act as a regulatory umpire.

Should the members contribute, this also means they can charge a fee for transactions on the cNGN to recoup their investment. This was not possible with the eNaira, which was entirely controlled by the CBN, and other financial institutions were not allowed to layer their products on the technology.

“They will have to think about ways of making money, which could include charges on transactions, but any potential users will immediately reject it if the costs are not competitive,” said Olaoluwa Samuel-Biyi, co-founder of SureGifts and Busha. “Users in the industry are very price-sensitive and they will use it only if it’s fast and almost fee-less.”

According to Olusegun Dada, a media aide to President Bola Tinubu, the cNGN is similar to other stablecoins like USDT and USDC and will join other currencies that can be used to trade from any part of the world. This suggests that the CBN is allowing financial institutions to be part of the highly speculative global cryptocurrency market through a stablecoin that is nationally controlled.

Earlier in January, when it announced that it was lifting the restriction placed on banks and other financial institutions from providing financial services to cryptocurrency-exposed businesses and closing their accounts, the CBN expressly said the banks were not allowed to hold or trade in cryptocurrencies.

“Nigerian banks and other fintech companies will launch the cNGN stable coin on February 27, 2024. The cNGN is part of the Central Bank’s efforts to ensure the Naira becomes a stable currency that can be relied on by investors and users across the globe,” Dada said. The expectation is that the stablecoin will be launched on major crypto exchange platforms like Binance, Coinbase and Kilpin.

Nonetheless, the cNGN does not come with a guarantee of speedy transactions, and experts say this might be a limitation, given that there are other payment channels where transactions both local and international are done with reduced wait times.

“If you’re a trader in Asia and you need some raw materials from Nigeria, it might be easier and cheaper for you to simply buy cNGN from an exchange somewhere and send it to your supplier in Nigeria or if you’re a Nigerian in the diaspora that want to hold a lot of naira, you can easily sell for some reason; cNGN might be a better option. Most use cases are international. The only local stakeholder that should think about how to get smarter is the tax man,” Samuel-Biyi said.

But the cNGN will launch with an inherited public distrust, no thanks to the eNaira. First, like the eNaira, it is pegged 1:1 to the naira, a currency that currently does not inspire market confidence. It is not only unstable, it has been ranked the worst-performing currency in Africa, and its outlook for the year, from many economists’ crystal balls, does not look very bright.

Nevertheless, some experts say the focus is on the bigger picture and not necessarily on the performance of the naira at the moment.

“The objective is to create a legitimate pathway for the country’s financial system network into the digital space. Nigerians are attracted to the USDT because it’s backed by the dollar, however, the cNGN can be used for local transactions,” said Olumide Adesina, a financial journalist and public commentator.

Samuel-Biyi does not think the cNGN would have been pegged to anything other than the naira.

“It can’t be pegged to anything that’s not naira-denominated because that is what will make it unstable. If they peg it to gold, the value would need to track the price of gold in naira. Note that a stablecoin is only stable against itself, and even Bitcoin is stable when measured against Bitcoin (1 BTC is always 1 BTC). No asset can be ‘stable’ when compared to another asset (e.g. USD) unless they’re perfectly correlated. It’s best to just think of it as naira on the blockchain, just as USDC is dollars on the blockchain,” Samuel-Biyi said.

However, should the CBN provide most of the funding for the cNGN, the potential for government control and monopoly arises. Also, the commitment of the members of the consortium is only to the extent that the cNGN doesn’t expose them to significant financial risks. Would all members of the consortium be invested in a project they have no financial stake in? How long would it take before the various banks’ shareholders pull their banks out of the project? Stablecoins are not without their problems. The massive market volatility the crypto market faced in 2022 is partly linked to the troubles of TerraUSD (UST).

However, experts say the technical and cost requirements of a naira stablecoin are actually quite low.

“Remember, Buycoins did it with NGNT already, so it’s low-risk on the capital side. The advantage they have is that they have the network for broader distribution. Also, if it fails, nothing is really lost except the technology costs. The banks will not be using their own capital as reserves; it’s the cNGN users’ naira that will be used to back the token,” said Samuel-Biyi.

There is still the question of whether the fundamentals that contributed to the failure of eNaira are being addressed in the cNGN. Adedeji Olowe, CEO of Lendsqr, makes the point that there needs to be a guarantee of sufficient foreign reserves in order to adequately support international transactions. The country’s foreign reserve is depleted and is primarily responsible for the FX crisis and the weakening of the naira.

“The problem is never about the currency; it is the economics about the performance of the currency and that is what we don’t have. The problem that cryptos fail to solve is that currencies are based on the fundamentals of the country’s currency. So long as it does not exist, it doesn’t work well,” Olowe said.