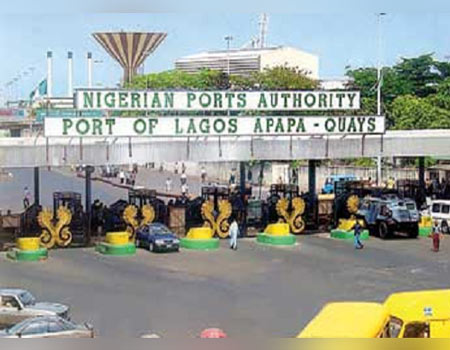

Many cargoes are currently trapped at the Apapa and Tin-Can Ports following persistent disruption to some online services of some commercial banks in Nigeria due to the upgrade of their electronic banking portals.

Checks by the Nigerian Tribune revealed that many import units of containers have not been cleared because their clearance documents are still trapped in some banks due to ongoing network migration issues.

Speaking with the Nigerian Tribune exclusively, the National President of the Africa Association of Professional Freight Forwarders and Logistics of Nigeria (APFFLON), Mr. Frank Ogunojemite lamented that the reason many jobs are stuck is because the moment an agent captures a job in a bank, he cannot move the job to another bank even if the first bank network is bad.

According to the APFFLON National President, “The clearance of cargoes at the ports usually goes through Form M and the Pre Arrival Assessment Report (PAAR).

“For you to begin the clearance process, the transaction has to go through a commercial bank because you have to pay your Customs duty.

“If the banking system or network is down, then there is no way you can pay for Customs duty, and if that is the case, then the container will remain in the port accumulating rent which comes with storage and demurrage payments.

“If this kind of situation persists, then there is no way prices of goods can come down because cargoes are spending longer time in the ports due to disruptions to banking services.

“Government should introduce what is called a ‘compensatory law’ where importers are given waivers when delays to their cargoes inside the ports is not from them.

“Most oftentimes, the banks will tell us that they apologise for the network disruptions, but the question is: does this apology make any meaning to the cargo clearance chain?

“There should be a compensatory law where cargo owners are given waivers due to issues beyond them that delay cargoes inside the ports.

“There was a time Unity Bank was down for weeks and then it became the turn of Guaranty Trust Bank (GTB) and Zenith Bank. Most of the banks are migrating their system to higher versions, and this is telling on cargo clearance.

“Amid all these delays, the cargoes are accumulating storage and demurrage charges which the cargo owners are being forced to pay. How does government expect cost of goods to come down when the same goods have already accumulated charges right inside the ports?

“Naturally, the cargo owners transfer the accumulated charges on the cost of the goods, and that is why the cost of goods in our markets keeps skyrocketing.”

When asked why agents cannot move clearance jobs from one bank to another if a bank has network issues, Mr. Ogunojemite explained, “The moment an agent captures his Form M and PAAR in a particular bank, he cannot move the job to another bank if the bank has network issues.

“If it takes weeks or months for the bank to resolve its network issues, that is when the agent can continue with his job. the agent cannot move his job to another bank once the job has been captured in the first bank.

“We are hearing that First Bank too wants to migrate, and everybody is beginning to panic. However, the bank has come out to say the migration won’t affect customers, but we are watching.”

Also speaking, haulage operators bemoaned the effect of the various banking migrations on picking of containers inside the ports.

“Many of our members have had issues picking up containers inside the ports because monies sent to them by clearing agents often take days to reflect in their accounts.

“Thus, some containers spent longer days in the ports because truckers won’t pick up such cargoes since funds have not been received, particularly if it’s a first-time customer. In some cases, the funds eventually arrived days or weeks after, but the container would have spent extra days inside the ports.

“In some case, the agents would have reached out to other haulage operators and by the time the money will reflect in the account of the trucker, the cargo has been moved out of the ports, thus costing the trucker the client. Many of us lost customers due to the ongoing banking migrations while some cargoes spent extra days in the ports over same issues,” Chief Remi Ogungbemi, Chairman, Association of Maritime Truck Owners (AMATO) told the Nigerian Tribune.

READ ALSO: How I would have solved Nigeria’s problems as president — Atiku