The freefall of naira, one of the world’s worst-performing currencies last year, has sparked a bloodbath among multinational companies operating in Nigeria, with shareholders funds taking a record hit and foreign exchange-related losses piling up.

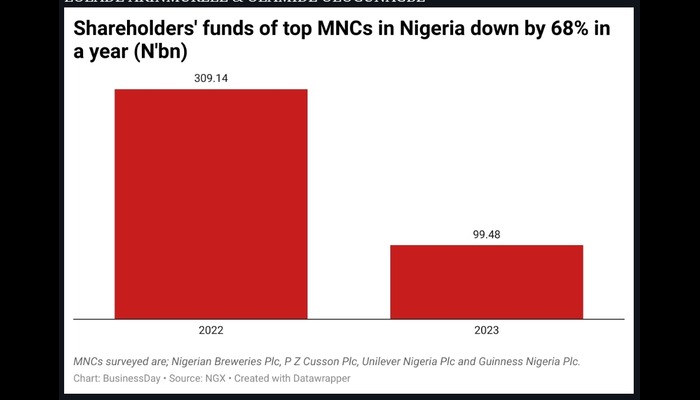

The combined net asset position of five multinationals surveyed by BusinessDay which include the Nigerian units of Cadbury, PZ Cussons, Unilever, Guinness and Nigerian Breweries fell 68 percent to N99.8 billion as at the end of 2023 (with PZ Cussons Nigeria the only company with numbers reported as at November 2023) from N309.14 billion in 2022.

A de facto naira devaluation last June adversely affected multinational companies whose liabilities are dominated by foreign currency-denominated borrowings from parent companies and related parties.

Combined losses hit N204.77 billion

The naira shed over 40 percent of its value against the dollar last year following the CBN’s currency reform that saw banks start to quote the naira freely, making it one of the worst-performing currencies in the world.

Shareholders of PZ Cussons Nigeria and Cadbury Nigeria were the worst hit with both firms recording negative net assets of N23.2 billion and N15 billion respectively. For both firms, it’s the first time that total liabilities exceed total assets in their long history doing business in Nigeria.

When a company’s net asset position is negative, this is not only a sign that it is in critical financial condition, but this could also result in the company’s liquidation.

PZ Cussons Nigeria, the local unit of the British healthcare and consumer goods giant, recorded a negative net asset position for the first time in its 125 year business in Nigeria after the naira depreciation eroded earnings and wiped out shareholders’ funds.

The company specifically attributed the negative net asset position to a N87 billion loss from foreign currency-denominated trade obligations which led to an operating loss of N73.8 billion in the period.

The company has summoned shareholders to an extraordinary general meeting to be held on 13 March to discuss the issue.

Cadbury Nigeria’s net asset position is also negative with total liabilities exceeding total assets by N15 billion in the period under review.

The net assets of Nigerian Breweries tumbled by 64.8 percent to N63.28 billion in 2023 from N179.91 billion in 2022.

The net assets of Guinness Nigeria Plc fell 34 percent to N51.7 billion from N78.62 billion in the period. Unilever Nigeria Plc bucked the trend with net assets rising 10 percent to N74.45 billion from N67.56 billion.

Unilever’s total assets declined but the firm was able to cut its total liabilities by 19 percent to N46.46 billion from N57.83 billion. Unilever stopped the production of its homecare and skin-cleansing brands which include Omo, Sunlight and Lux last year.

The naira devaluation adversely affected multinational companies whose liabilities are dominated by foreign currency-denominated borrowings from parent companies and related parties.

The five multinationals surveyed posted a combined loss of N204.77 billion last year compared to profit of N29.3 billion in 2022, according to data from their financial statements.

Cadbury, Nigerian Breweries, Guinness and PZ Cussons Nigeria all declared losses with Unilever Nigeria the only exception.

Nigerian Breweries, backed by Heineken NV, slumped to its biggest loss on record. The beer maker, Nigeria’s largest, posted a loss of N106.31 billion.

Hans Essaadi, the company’s CEO, told investors during a call that the company was facing its worst downturn in the history of its operations in Nigeria.

“It has been an unprecedented year for our business in Nigeria,” Essaadi said.

“We saw a significant decline in the mainstream lager market as a result of Nigerian consumers no longer able to afford a Goldberg after a hard day’s work,” he said, adding that the businesses also suffered huge losses because of the naira devaluation, which resulted in a N153 billion foreign exchange loss.

PZ Cussons Nigeria, which also suffered its worst outing in its 125 year history of doing business in Nigeria, posted a loss of N74.14 billion while Cadbury and Guinness Nigeria Plc slumped to a loss of N27.63 billion and N5.23 billion respectively.

The worst may well be yet to come for weary multinationals as the naira has continued its free-fall this year, losing a further 30 percent of its value against the dollar.

FG’s 2024 tax receipts at risk

The record losses being declared by the multinational firms in Nigeria is likely to hit the government’s tax receipts thereby widening the projected deficit for the budget.

Nigeria expects to significantly boost revenue collections this year as plans to overhaul its tax system start to pay dividends.

The Federal Inland Revenue Service forecasts revenue to increase 57 percent in 2024 to N19.4 trillion, compared with last year. That will comprise N9.96 trillion in tax revenue from oil and N9.45 trillion of non-oil revenue.