Six commercial banks increased their spending on information and technology (IT) by 44.66 percent to N205.34 billion as more customers carried out electronic transactions, data compiled by BusinessDay show.

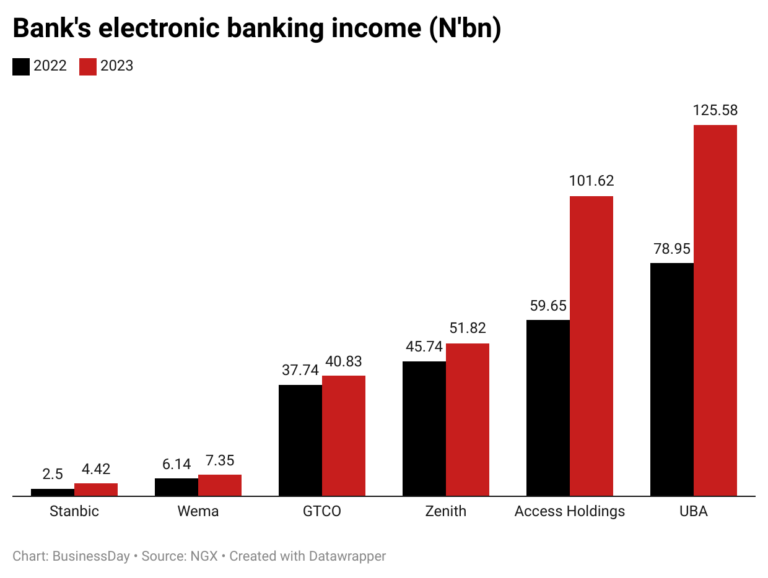

The lenders saw their income from electronic transactions rise by 43.73 percent to N331.61 billion, according to their financial statements, underscoring the shift in the country’s payment landscape.

Read also: Information technology is key to digital economic drive – Westgate

Access Holdings Plc, the parent company of Access Bank, spent the most (N78.05 billion) on IT last year.

Guaranty Trust Holding Company (GTCO), the owner of GTBank, increased its IT expenses to N50.24 billion, while Zenith Bank spent N33.59 billion.

The United Bank for Africa Plc (UBA) spent N23.19 billion; Stanbic IBTC Holdings Plc, N19.34 billion; and Wema Bank did N1.42 billion.

UBA reported the most electronic banking income of N125.58 billion. Access earned N101.62 billion from electronic transactions; Zenith, N51.82 billion; GTCO, N40.83 billion; Wema, N7.35 billion; and Stanbic, N4.42 billion.

Read also: CBN to conduct e-payment infrastructure audit

E-payment has surged in Nigeria in recent years. According to the Nigeria Inter-Bank Settlement System, electronic payments grew by 54.55 percent year-on-year to N611.06 trillion in 2023 from N395.38 trillion in 2022.

Instant payment channels, including mobile, recorded a usage volume of 9.67 billion.

Cashless transactions in the country have been partly boosted by the Central Bank of Nigeria’s (CBN) botched naira redesign policy and withdrawal limits introduced in December 2022.

The country aims to go cashless, with the CBN, in a ‘Payments Vision 2025’ document, predicting that the use of cash payment should have lessened by 2025. Most of these online transactions are expected to be facilitated by banks and fintechs.

By 2025, the apex bank expects the country to have a cashless and efficient electronic payment system infrastructure.

“As we implement the PSV 2025 agenda, the CBN will continue to ensure that the Nigerian payments system is widely utilised domestically, supports government’s financial inclusion objectives, and meets international standards while contributing to overall national economic growth and development of Nigeria,” the CBN said.

As banks go online, failed transactions and system glitches have become rampant, with customers constantly taking to social media to complain. In 2023, online banking downtime nearly became a norm, and many customers of a tier-one bank were recently shut out from their apps.

“We understand that you rely on the availability of our services to carry out transactions that are important to your daily lives and your business operations, which is why we take very personally our commitment to continuously deploy resources to ensure that our service uptime is 100 percent, round the clock, every day of the week,” GTBank said on Monday.

“Unfortunately, we experienced an unusual power surge. We immediately set to work to minimise the impact of this unexpected surge on our services, and we were able to get our channels back up.”

In 2023, the World Bank stated that Nigeria’s digital and financial infrastructure was still inadequate to support a swift shift to a cashless economy.

Banks’ IT spending is expected to continue rising because of the anticipated increase in cashless transactions in the country.

Femi Adeoti, group managing director of RoutePay, said recently: “We realised that Nigeria’s current banking and digital payment infrastructure is inadequate to cater to the expected growth in the volume of digital/electronic-based transactions.”

Dahlia Khalifa, regional director for Central Africa and Anglophone West Africa at the International Finance Corporation, said recently that fintech is driving the transformation of Nigeria’s traditional banking systems at an unprecedented pace, increasing the reach and efficiency of financial services in the country.

“Through mobile banking, digital payments, and other innovations, fintech is extending financial services to previously underserved communities, driving financial inclusion and widening economic opportunities,” Khalifa said.