Olayemi Cardoso, the governor of the Central Bank of Nigeria, has said that the various reforms by the CBN will eventually bring back Foreign Portfolio Investments (FPI) to the country. The country’s illiquid FX market can’t wait for this to happen.

“A lot of FPI are still interested in coming back to the country. They have taken a lot of methodical interest in understanding the reforms that have taken place and seeing how it is taking the country in the right direction,” Cardoso said in an interview on Arise TV.

“They also see rating agencies coming out with their own conclusions of how they see the economy of the country progressing, it validates what they are thinking, we do additional reforms, it continues to please them,” he said.

Cardoso assured that the time to panic was over, and that “we are on the road now where the right policy decisions are being taken.”

But the Domestic and Foreign Portfolio Investment report by the Nigerian Exchange Limited last December shows the road to getting FPIs back is still long.

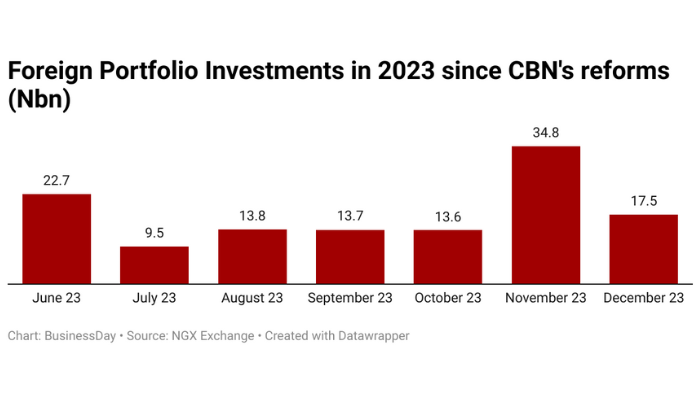

According to the report, Africa’s most populated nation’s FPI stood at 22.72 billion naira in June 2023 when the reforms took effect, but fell to 17.48 billion naira by December.

Nigeria only saw a rise in its foreign investment in November when it rose from 13.62 billion naira in October to 34.77 billion naira.

When compared to 2023, the total FPI in 2022 was 195.76 billion naira as against the 174.80 billion naira seen last year.

Similarly, foreign investments in Africa’s biggest economy dropped to $654.7 million in the third quarter of 2023, the lowest level since the National Bureau of Statistics (NBS) started gathering the data in 2013.

The report by NBS, showed that total capital importation into Africa’s biggest economy declined by 36.5 percent to $654.7 million in Q3 from $1.03 billion in the previous quarter. It also declined on a year-on-year basis by 43.6 percent from $1.16 billion in Q3 2022.

“Other investment ranked top accounting for 77.6 percent ($507.6 million) of total capital importation in Q3, followed by Portfolio Investment with 13.3 ($87.1 million) and Foreign Direct Investment (FDI) with 9.13 percent ($59.8 million),” the report revealed.

Last June, the Federal Government implemented key economic reforms. They are the removal of petrol subsidies, merging all foreign exchange segments into a single market and tightening of monetary policy.

The FX reform has led to a large devaluation of the naira which is currently at N1445/1 USD against N76o at the parallel market in June.

Cardoso said in the interview that the FX situation should not be blamed on the central bank, insisting that the apex bank relies on FX inflows and has no power over it.

“This is a problem I sometimes have when many blame the central bank for the FX situation. We rely on what comes in, we don’t produce foreign exchange; all we can try to do is use that to leverage for more foreign exchange to come in, including foreign direct investments, foreign portfolio investors,” he said.