The Central Bank of Nigeria has disclosed that its restriction on fintechs onboarding new customers may last for months.

In April, the CBN asked at least four fintechs — OPay, Moniepoint, PalmPay, and Kuda Bank — to suspend account opening for new customers over Know Your Customers issues. The directive was also in connection with an ongoing clampdown on Peer-to-Peer cryptocurrency transactions in the country.

At the time of their suspension, the affected fintechs warned customers to desist from crypto transactions on their platforms because they are obliged to report such activities.

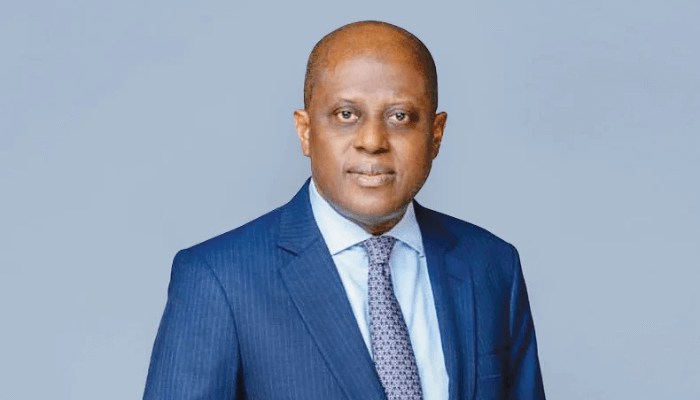

Olayemi Cardoso, governor of the CBN, revealed on Tuesday at the 295th Monetary Policy Committee that these fintech firms will resume enrolling new customers in another couple of months.

Read also: Four fintechs suspend account opening on KYC issues

“I am confident that as time goes on, and hopefully in another couple of months, all these will be something of the past and then you will see that sector going back into what they’ve been known to do before, but certainly with a very stronger regulatory framework,” he said.

According to the CBN boss, the apex bank has engaged with many players regarding the need to strengthen their operations, and the directive was part of actions to block money laundering and illicit flows.

Cardoso further stressed the importance of regulation in the fintech space. “However, regulation is very critical in a sector that seems to have grown so incredibly rapidly,” he said.

During one of his first public engagements in November 2023, the apex bank governor declared that the bank would review its licensing framework for payment services.

He said, “Technology will continue to play a critical role in delivering financial services and enhancing financial inclusion. However, recent developments in the payment services landscape have raised concerns regarding the use of technology and the existing licensing and regulatory framework.”

Experts have said that fintechs’ continued restriction of account opening is hurting businesses and financial inclusion in the country.