Funding into the African tech ecosystem dropped 64 percent to $466 million in the first quarter of 2023.

This underscored the consistent drop in venture capital funding on the continent, which fell from $1.3 billion raised in the same period of 2022, according to Africa The Big Deal.

Oyindolapo Olusesi, co-founder of Mustarred Crest, attributed the decline in funding to the economy’s prevailing macroeconomic issues, tightening monetary policies, and hikes in interest rates.

“This has consequently resulted in a rise in startup closures, employee layoffs, and valuation cuts,” he said.

A breakdown of the quarter analysis of investments into startups in Africa showed that 71 percent ($332 million) was raised as equity while 28 percent ($132 million) was debt.

Amani Velly-Awela, Senior Financial Advisory Services, Mazars, stated that investors prefer equity financing as its utilisation is more straightforward to monitor.

“Most early-stage startups typically prefer equity financing because it puts less pressure on the business’s growing revenue,” Velly-Awela affirmed.

Regarding the number of deals raised, startups in Africa collectively raised 121 deals in the first half of last year compared to 169 deals raised in the same period of 2023.

However, on a month-month breakdown, January reported $77 million in 38+ deals, making January 2024 the second-lowest month of fundraising announced since early 2021. This was a 27 percent decline from the $106 million raised in January 2023.

African startups collectively raised $389 million in February and March, a 49 percent decline from the $766 million raised in the first quarter of 2023.

Nigeria overtakes Kenya

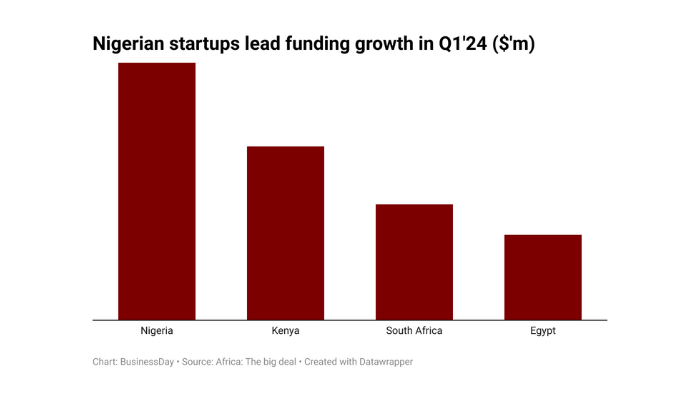

In 2023, Kenya acquired the most funding in Africa. However, the first quarter of this year was positive for Africa’s most populous country, Nigeria.

Africa The Big Deal noted, “87 percent of the funding went to start-ups headquartered in the Big Four with 60 percent going to Nigeria (2/3 of which were the Moove deals) and Kenya. Few other countries managed to claim more than $5 million in funding during the period.”

A breakdown of the data revealed that among the Big Four, Nigeria led with $160 million, Kenya raised $108 million, South Africa had $72 million, and Egypt had $53 million.

African investors set record

According to the report, the logistics and transport sector attracted the highest funding in the year’s first quarter, totaling $151 million from 14 deals.

It said, “Transport and logistics snatched the number one spot in terms of the total amount raised. Africa Moove’s startup raised $110 million in Q1 2024, and Uber’s $100 million series B round attracted more than 24 percent of the funding on the continent in Q1.”

Fintech attracted the second most funding, with $105 million. This was followed by agric and food, which raised $50 million, followed by energy with $49 million, and Healthcare with $45 million.