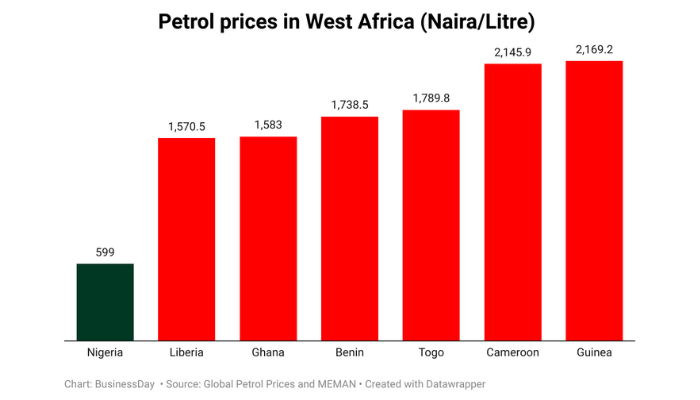

The price of Premium Motor Spirit (PMS), popularly known as petrol, in Nigeria, remains the cheapest in West Africa despite the exchange rate standing at N1,555 per dollar, indicating that subsidy on the product was reduced not removed as claimed by the federal government.

Data obtained from the Global Petrol Prices, a website that tracks retail prices of refined petroleum products, revealed that the cost of petrol in Nigeria stood at $0.39 per litre.

Read also: Fuel scarcity looms as petrol transporters plan to shut down on Monday

Using the exchange rate of N1,555/$, the Major Energy Marketers Association of Nigeria calculations placed a litre of the commodity at N599.

The differential between Nigeria and Liberia, the second cheapest in the region with N1,570.5 ($1.01) is N971.5, showing that prices between the country and the rest of West Africa are now wider than it was nine months ago, which creates arbitrage incentivising the smuggling of petrol from Nigerian borders.

Analysts have said there is a lack of transparency among stakeholders in the sector, citing that this development could breed intense smuggling, stealing and pipeline vandalism.

“Subsidy is back. The faster all Marketers have access to dollars and the Nigerian National Petroleum Company (NNPC) Limited isn’t the sole importer the better,” Jide Pratt, country manager of Trade Grid, said.

According to him, the books of the state-owned oil company need to be audited as it is “clearly warehousing this differential in my opinion and needs to be opened up for probity.

He said: “At NNPC retail, petrol sells for N568 per litre in Lagos versus N599 – N610 per litre at other Marketers, that’s a price advantage of N30 – N40 naira per litre. Hard to justify and a lot needs to be done.

“Until the government is no longer the owner of 100 percent shares nothing will change.”

The NNPC transformed from a corporation to a company in July 2022 through the Petroleum Industry Act (PIA) 2021. It was expected to be independent of government interference and operate without state funding, with the new goal of delivering value to its shareholders.

However, a look into the Petroleum Industry Act 2021 showed that the shareholders of the NNPCL include the Federal Government, represented by the Ministry of Finance Incorporated and the Ministry of Petroleum Incorporated.

Read also: Petrol subsidy nears N1trn monthly, bigger than when Tinubu came

According to the PIA, the shares are held in equal portions by the two ministries.

“Nobody can import petrol in Nigeria now as things stand apart from NNPCL. If they operate as a business they will not import fuel and sell at the current price. That’s setting fire to money,” Eze Odiri, a public sector consultant, said.

According to him, “They will buy and sell on Government instructions. They will then use that authority to deduct at source revenues accruing to the Federation. Back to square one.”

He said that the two policy changes of Government, fiscal with the abolition of fuel subsidies and monetary by the convergence of Naira exchange rates have considerable effects on the economy even if effected separately.

“With the application of these policy changes at the same time a situation has arisen where the managers of the economy do not know which policy caused which undesirable outcome.

“So the subsidy is back, that is quite clear and what we aimed to achieve by way of removing the incentive of smuggling petrol across borders has been defeated.

“Unfortunately this will open the door once again for the NNPCL to withhold federation revenues in the name of under-recovery/subsidy/provision of strategic reserves, etc.,” he added.

Kelvin Emmanuel, CEO of Dairy Hills Limited, also affirmed that the government is still subsidising the product and according to him, smuggling continues.

In November 2023, Ogbonnaya Orji, Executive Secretary of the Nigeria Extractive Industries Transparency Initiative (NEITI), a government agency, emphasised the grave consequences of oil theft, stressing its detrimental impact on oil exploration, exploitation, economic growth, business prospects, and oil company profits.

Read also: Petrol landing cost hits N1,000/litre on FX crisis

Orji provided staggering data from NEITI’s reports, revealing that between 2017 and 2021, Nigeria recorded 7,143 cases of pipeline breakages and deliberate vandalism, resulting in the theft of 208.639 million barrels of crude oil, valued at $12.74 million or N4.325 trillion.