Any Kenyan looking to aplly for a job within the country is probably familiar with the Chapter 6 of the Constitution’s requirements to demonstrate to your would-be employer that indeed, you are an upstanding member of society.

These documents include a Certificate of Good Conduct from the Directorate of Criminal Investigations (DCI), a Clearance Certificate from the Higher Education Loans Board (HELB), a Tax Compliance Certificate from the taxman, Kenya Revenue Authority (KRA), and of course, Clearance Certificate from a Credit Reference Bureau (CRB).

Advertisement – Continue reading below

See, the Central Bank of Kenya (CBK) licenses Credit Reference Bureau (CRBs) to collect, manage, and distribute credit information. These CRBs collect information from money lenders and store it in a database. They then develop a credit score for every person whose credit information has been submitted to the bureau.

This credit score is used by financial institutions to determine the creditworthiness of an individual.

How to Get your CRB Clearance Certificate

If you are interested in checking your CRB status, you can register with one or all of the three licensed CRB companies in Kenya:

I’ll be using CreditInfo, although Metropol services are easier as they have a mobile app to have you perform many tasks from the convenience of your phone or PC.

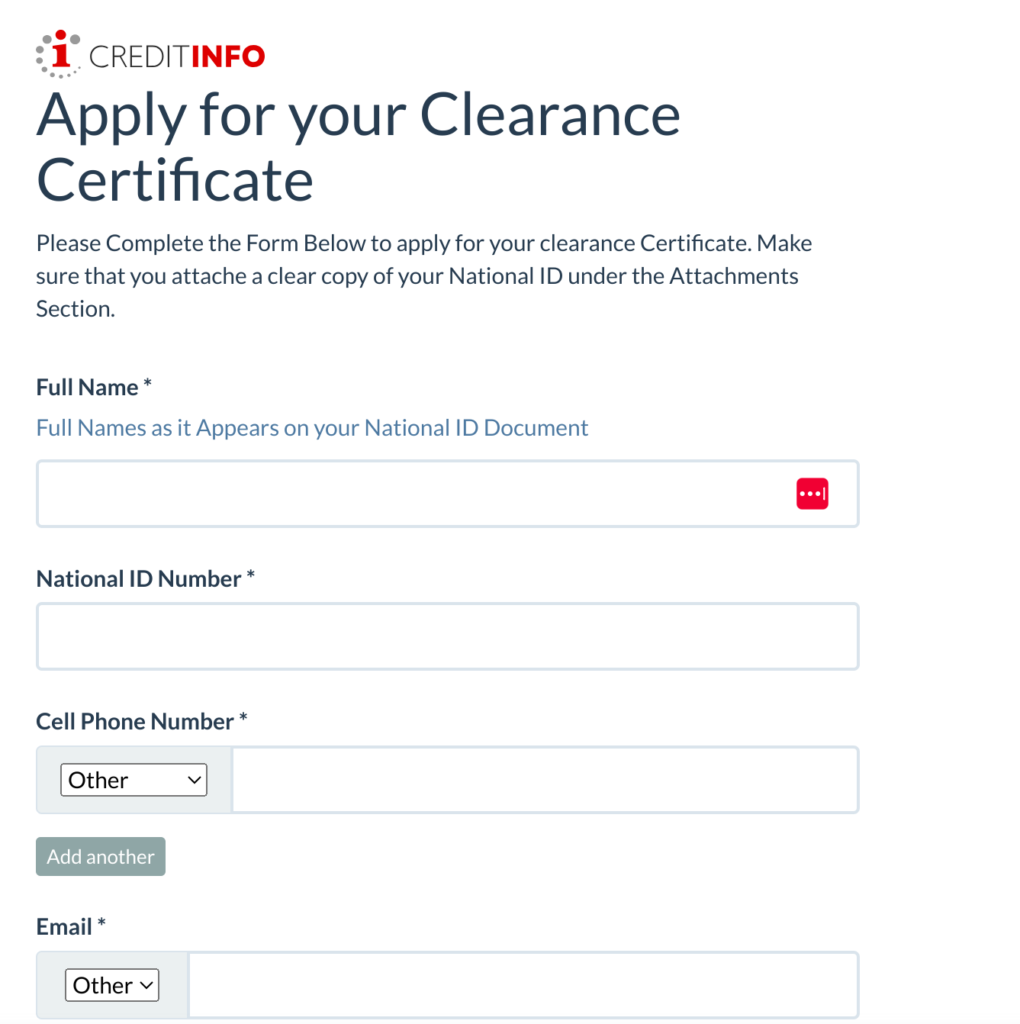

- Go to CreditInfo and Click on Apply for Personal Clearance Certificate

- Fill in the details required. These include ID Number, e-mail addresses, phone number and a photo of your ID.

You will be asked to pay the application fee of KES 2200 via Mobile money and that’s it. If you do not have a negative listing on your credit report, you will get a clearance certificate. If you have a negative listing on your credit report, you will be issued a credit status certificate.

Advertisement – Continue reading below

Note that this clearance certificate is valid for 1 year and you might need to renew should you have need for one after expiry of this one.