From Buenos Aires to Caracas and Khartoum to Harare, people worldwide are labouring under the burden of price increases on everyday goods and services.

The worst inflation spike in decades has come due to the coronavirus pandemic of 2020 and became compounded by Russia’s invasion of Ukraine in 2022, which is yet to see an end.

During this prolonged period, the challenge for policymakers and central banks worldwide has remained: tame inflation. The general approach has been to hike interest rates speedily and sufficiently to slow down economies and put the brakes on stubborn rising prices.

Failing to achieve these goals is a destabilising period of spiralling prices. Against such a backdrop, households and businesses struggle to balance their lifestyles and generally plan for their futures.

Data from the United Nations revealed that in 2023, 1.1 billion out of 6.1 billion people, just over 18 per cent, live in acute multidimensional poverty across 110 countries.

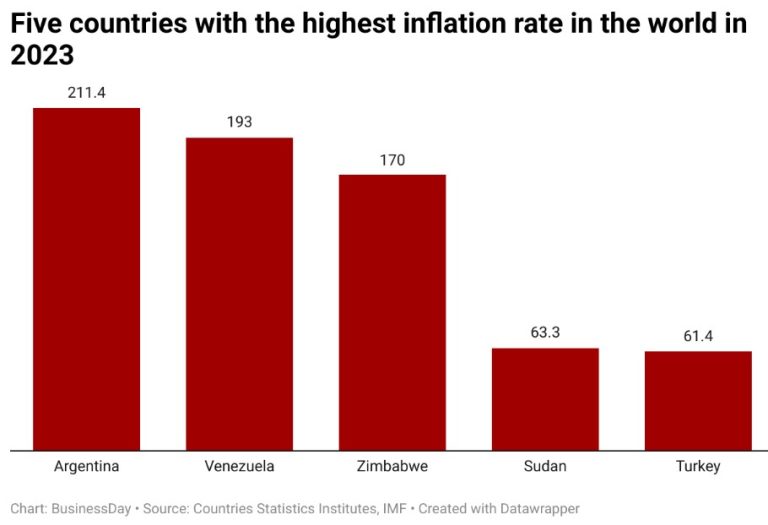

Here are the top five countries battling with the scourge of inflation

Argentina: Argentina has taken the unwelcome regional inflation crown from Venezuela, becoming the Latin American country with the highest inflation rate in 2023 after prices rose over 200 percent last year, the highest level in three decades, according to Reuters.

The South American grains producer reported annual inflation of 211.4 percent, with prices rising 25.5 percent in December alone.

Inflation in Argentina has been massively elevated since its economy descended into crisis in 2018, when its foreign-debt obligations expanded to unsustainable levels and the peso collapsed against the US dollar.

Newly elected Argentine President Javier Milei has warned of the risk of hyperinflation and is pushing major reforms and tough austerity measures to tame prices.

Venezuela: Venezuela’s annual inflation rate settled at 189.8 percent last year, according to data from the central bank, marking a slight easing of the still sky-high rate of rising consumer prices in the South American nation’s battered economy.

Venezuela’s socialist government has loosened currency controls, relaxed import restrictions, and encouraged informal dollarisation to try to keep a lid on consumer prices in recent years, helping gradually bring inflation down.

The inflation rate during the previous year clocked in at 234 percent, one of the highest inflation rates anywhere in the world. But Venezuela’s monthly inflation for December eased to just 2.4 percent, according to the bank.

Zimbabwe: Zimbabwe saw its annual consumer price inflation rate skyrocket to about 170 percent in June 2023, according to the IMF, stoked by a sharp depreciation in the Zimbabwean dollar. Zimbabwe’s weak currency has been the major determinant of its persistent inflation.

The World Bank said that since June 2023, the Zimbabwean government has proactively tightened monetary policy to bring down inflation and the parallel market premium. It also extended the use of US dollars as legal tender until 2030, further reducing policy uncertainty.

According to the IMF, over 16 million population is projected to witness a spike in inflation rate by 2024 at 222.4 per cent.

Sudan: According to the Sudan Bureau of Statistics, the inflation rate in Sudan decreased to 63.30 percent in February from 83.60 percent in January of 2023. Inflation Rate in Sudan averaged 69.50 percent from 1971 until 2023, reaching an all time high of 422.78 percent in July of 2021 and a record low of -1.00 percent in December of 1979.

With a population of over 49 million, Sudan lies at the crossroads of Sub-Saharan Africa and the Middle East, bordering the Red Sea. It shares its border with seven countries: Libya, Egypt, Chad, the Central African Republic, South Sudan, Ethiopia, and Eritrea.

The secession of South Sudan led to multiple economic shocks, including the loss of oil revenue that had accounted for more than half of the Sudan government’s revenue and 95 percent of its exports. This has reduced economic growth and resulted in double-digit consumer price inflation.

Turkey: Turkish annual consumer price inflation dipped to 61.36% in October – the first time in three months, a report from its statistics institute showed.

The fallout eased from the lira’s sharp summer decline and post-election tax hikes. Month-on-month, inflation stood at 3.43%.

Rising prices of clothing and shoes, houses and hotels, and restaurants drove the monthly measure higher.

Turkish’s inflation is expected to continue rising and peak in May 2024 at around 70-75 percent, according to the central bank which has raised its year-end inflation forecasts to 65 percent.