Your credit score is an essential factor that lenders use to determine your creditworthiness. If you’re planning to apply for a loan, mortgage, or any form of credit in Uganda, knowing your credit score is a vital step. Here’s a guide to help you understand how to access your credit score in Uganda.

To know your credit score, you will need to obtain a credit report from one of the Credit reference bureaus(CRB) in Uganda.

What is a Credit Reference Bureau (CRB)?

A Credit Reference Bureau (CRB) is a company licensed by the Bank of Uganda to collect and compile credit information on individuals and businesses. The CRB sources this data from financial institutions like banks, credit institutions, and microfinance deposit-taking institutions. The information is then shared with authorized users to help them make informed credit decisions.

Advertisement – Continue reading below

What is a Credit Report?

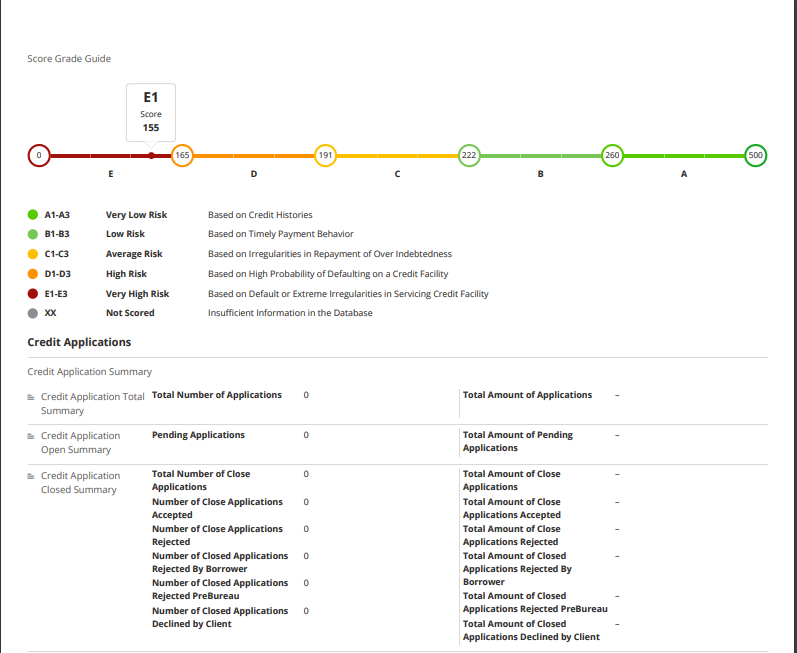

A credit report is a comprehensive record of your borrowing and repayment history. Prepared by a CRB, it provides crucial details about how you’ve managed credit in the past. Financial institutions use these reports to assess your creditworthiness, mitigate risks, prevent fraud, and ensure compliance.

Credit reports are vital for various purposes, including:

- Assessing credit applicants (e.g., agents and distributors).

- Vetting employees under Know Your Employee (KYE) solutions.

- Evaluating post-paid account holders.

By leveraging credit reports, financial institutions can make more informed decisions and implement effective credit control measures.

Currently there three CRBs in Uganda all under an umbrella body, the Credit Reference Bureaus Association Uganda. This association has three members:

All credit reference bureaus in Uganda are regulated by the Central Bank of Uganda to ensure compliance and reliability.

How to Get Your Credit Report

If you want to access your credit report, you can get it through any of the three CRBs. I personally used the Creditinfo CRB Uganda. If you choose to use Creditinfo, here’s how to get your credit report:

Advertisement – Continue reading below

Free Credit Reports

You are entitled to two free credit reports within a 12-month period. To access your free report, follow these steps:

- Visit Creditinfo’s website.

- Go to consumer information menu, then Get yoru credit report section and click on the “Request your credit report ” button. You will be asked to fill in a form.

To process your credit report request, you must provide:

- Your full name

- Phone number

- Email address

- National ID number

- Proof of identity:

- National ID for individuals

- Passport for foreigners

- Registration/incorporation certificate for businesses

You will receive your credit report shortly in your email inbox as a PDF with instructions on how to open it.

Why Your Credit Report Matters

Your credit report provides critical insights into your financial behavior. Maintaining a good credit score can help you:

- Secure loans at better interest rates.

- Improve your chances of loan approval.

- Build trust with financial institutions.

By staying informed about your credit status, you can take proactive steps to enhance your financial health and achieve your goals.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.