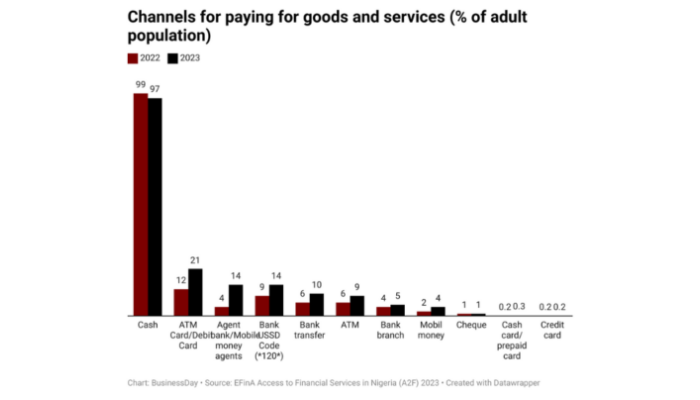

Over 45 percent of the adult population in Nigeria in 2023 transacted digitally compared to 34 percent in 2022, according to Enhancing Financial Innovation and Access (EFInA). This highlights the country’s growth in digital financial services (DFS).

According to the Access to Finance 2023 Survey, DFS in Nigeria is predominantly bank-based. Most adults (45 percent) used DFS through banking channels, and 13 percent performed DFS through other formal channels.

“For both bank and other formal DFS usage, merchant payments and remittances are the most common transactions,” it said.

Oluwatomi Eromosele, the general manager and research manager at EFInA, stated in an EFInA podcast that this demonstrates the increasing adoption of digital financial services as more people start using financial products for their transactions.

She said, “We also see that through the financial service agent network in local communities, agents are extending formal financial services to about 11 million Nigerians who are not banked but are actively engaged in financial offerings. This tells us the power of technology to reach the excluded underserved.

“To ensure that these agent network communities continue to grow, we also have to remain mindful of the potential risk associated with that.”

Read also: More Nigerians embracing digital payment – PalmPay MD

She explained that digital financial services are crucial because, even before COVID-19, it was clear that reaching excluded or rural communities would be very challenging without technology. The insecurities and weak infrastructure make it difficult for financial services to rely on the traditional brick-and-mortar model they used in the past.

“Even though there are communities where bank branches used to exist, many of these branches have now closed. It is essential to find ways to ensure that these individuals still receive access to financial services. Access is crucial, especially with ongoing innovations; people increasingly seek services that are convenient and efficient,”

In 2012, the Central Bank of Nigeria (CBN) introduced the cashless policy, which was meant to curb excessive cash handling and curtail the volume of cash in circulation. More importantly, the policy was introduced to drive the development and modernisation of payment systems capable of placing Nigeria among the top 20 economies in the world.

Also, the naira redesign initiative, initially introduced by the CBN in December 2022, appeared to have further spurred the adoption of digital financial platforms, with approximately 43 percent of adults reporting increased use of financial service agents due to the Naira redesign effect, according to the report.

“However, challenges like the cost of USSD, the high cost of smartphones, data privacy, cybersecurity, and digital literacy must be addressed collaboratively by policymakers, regulators, and industry stakeholders to ensure responsible digital financial practices and consumer trust,” it noted.