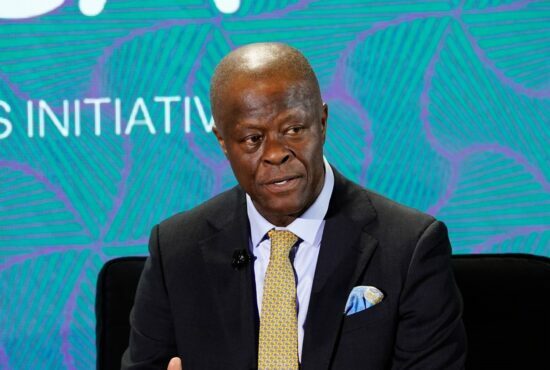

Minister of Finance, Wale Edun, has highlighted the unique difficulties facing the country as it grapples with inflation far more resistant to control than that of advanced economies, saying that the situation is compounded by structural factors including dependency on imports and a large informal economy.

Addressing the National Economic Council (NEC) on Tuesday at the Presidential Villa, Abuja, he said while developed nations have largely achieved stable inflation rates, Nigeria faces ongoing economic challenges linked to high inflation, subsidy removal, and foreign exchange reforms, which have placed significant strain on the populace.

Edun presented a range of government measures intended to mitigate the economic pressures on Nigeria’s citizens and spur sustainable growth.

He told correspondents that in his briefing to NEC, he emphasized the contrast between Nigeria’s inflationary pressures and the controlled inflation in advanced economies.

According to him, countries like the US and many in the Eurozone are seeing inflation levels close to their target of around 2% per annum, with countries such as Italy experiencing inflation rates even lower than 1%.

This stability is partly due to what Edun described as a “soft landing,” achieved by carefully balancing inflation control measures with continued economic growth and infrastructure spending.

“In our case,” he said, “inflation remains high, growth is relatively low, and debt levels continue to challenge economic stability.” Nigeria’s challenges are compounded by structural factors that affect inflation, including dependency on imports and a large informal economy.

He said the Tinubu administration has taken bold steps to address Nigeria’s economic woes by implementing long-overdue reforms, including the removal of subsidies on petroleum and foreign exchange.

According to the minister, previously, these subsidies cost the nation between $15 and $20 billion annually, a burden equivalent to around 5% of the country’s GDP.

While the subsidies’ removal was necessary, Edun acknowledged that it has led to a substantial increase in living costs, disproportionately affecting Nigeria’s poorer citizens.

However, he pointed out that the revenue freed up from these subsidies is now being redirected into critical social and infrastructure investments.

He noted that one of the administration’s notable initiatives is requiring local refineries to pay for crude oil in Naira, thereby stabilizing domestic petroleum pricing and reducing dependency on volatile international fuel markets.

According to Edun, this policy change alone has yielded an immediate fiscal boost of approximately N700 billion per month since October, with the funds funneled into the Federation Account to support national priorities.

The minister outlined a series of welfare initiatives aimed at alleviating the cost of living for Nigeria’s most vulnerable citizens.

These include a new minimum wage increase, direct financial assistance to households registered on the government’s social register, and wage support for low-income workers.

Edun reported that financial support payments have been disbursed to five million households, benefiting an estimated 25 million Nigerians.

Additionally, these payments are processed biometrically to ensure accuracy and avoid fraud.

He said a robust consumer credit scheme was also introduced to provide workers with access to affordable loans for essential goods and services.

Edun noted that over N3.5 billion has been distributed to 11,000 beneficiaries, enabling them to purchase compressed natural gas (CNG) kits for a more affordable and eco-friendly alternative fuel source.

Meanwhile, he stated, the administration’s student loan program has reached over half a million students, disbursing N90 billion to help cover educational costs and living expenses.

According to the minister, with food inflation a critical issue, the government has taken steps to address both the affordability and availability of staple foods.

Edun outlined a program to allow millers to import brown rice duty-free, which will be processed and sold at lower prices to ease the burden of high food costs.

In addition, he stated, the administration is encouraging increased domestic crop production, particularly in rice and wheat, with plans to support 600,000 farmers in upcoming planting seasons through subsidies on fertilizers, herbicides, and improved seeds.

Edun argued that recognizing the vital role of small businesses in Nigeria’s economy, the government has allocated nearly N50 billion in grants to support micro-enterprises, 90% of which has already been distributed.

Small and medium enterprises (SMEs) and large-scale industries are also receiving 9% interest loans to bolster growth and create jobs, with loan sizes capped at N1 billion to prevent excessive debt accumulation.

On foreign exchange and dollar repatriation programme, while acknowledging the impact of foreign exchange volatility on inflation, Edun announced a nine-month program encouraging Nigerians to deposit their offshore dollars into the local banking system.

The program, which begins October 31, aims to draw out dollars from informal holdings and integrate them into the formal economy.

The finance minister emphasized that no penalties or taxes would be imposed on deposits made through this program, as long as the funds comply with anti-money laundering regulations.

This initiative, Edun explained, seeks to strengthen Nigeria’s foreign reserves and ease exchange rate pressures, ultimately aiming to improve currency stability. The program guidelines, developed by the Ministry of Finance in conjunction with the Central Bank, will be released in detail in the coming weeks.

He underscored the government’s commitment to navigating Nigeria through this challenging economic period.

“We are making strides in addressing the country’s long-standing economic vulnerabilities,” he said, noting that the administration’s policies are both immediate and forward-looking, focused on creating an economy capable of sustained growth and resilience.

As Nigeria continues to battle its inflation crisis, the Tinubu administration remains under pressure to deliver on its promises to stabilize the economy and alleviate the financial strain on its citizens.

Edun expressed optimism that Nigeria can overcome its inflationary challenges and chart a path toward economic stability through a mix of subsidy reforms, targeted social interventions, and innovative financial policies.

ALSO READ THESE TOP STORIES FROM NIGERIAN TRIBUNE

Reps step down motion seeking to rescind Tinubu’s decision on Niger Delta Ministry