A recent report by Moniepoint has revealed that over 45.39 percent of Nigerians pay for medicines exclusively with digital channels. This is as 80 percent of Nigerian pharmacies pay their suppliers digitally, underscoring the growing reliance on payment channels for many businesses and Nigerians.

The payment company disclosed that this is due to the inconvenience of looking for change when someone pays with cash and the cash crunch crisis of 2023, which reduced the number of people who exclusively paid in cash. It noted that digital payments like POS and bank transfers are currently the dominant methods for receiving customer payments at pharmacies.

“The cash scarcity period was not a funny time. Customers would send money, show me a debit alert, and I’d be waiting for hours before seeing the alert on my end,” said Rita of Rite Life Pharmacy.

According to data from the Nigeria Inter-Bank Settlement System (NIBSS), cashless transactions rose by 45.41 percent year-on-year to N39.58tn in January 2023 because the scarcity of physical naira prompted many to adopt digital channels. By the end of the year, cashless transactions had peaked at over N600 trillion from N395.38 trillion in 2022 as more Nigerians embraced digital payment channels.

The payment company disclosed this in a report titled, ‘Inside Nigeria’s Community Pharmacies,’ which investigated the inner workings of pharmacies in Nigeria and the payment structures within their businesses.

Read also: NITDA outlines Nigeria’s two-fold approach to AI adoption

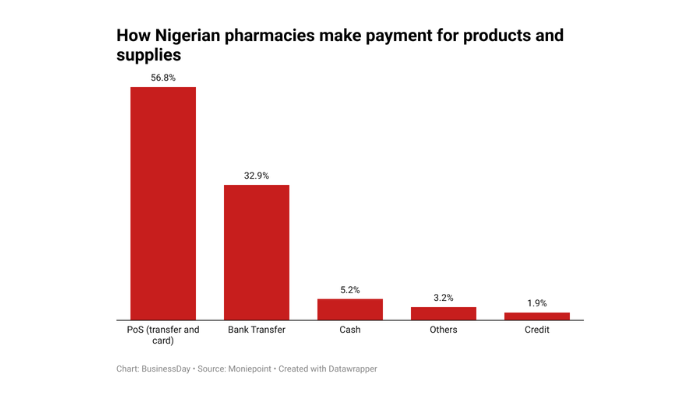

It said, “Eighty percent of Nigerian pharmacies pay for goods digitally with 56.8 percent of pharmacies paying for goods through cards and transfers on Point of Service (PoS) machines, while 32.9 percent pay with bank transfers. 5.2 percent pay by cash with 3.2 percent exploring other means and 1.9 percent employing credit facilities.”

“We typically deal with large sums of money, so it’s not wise to carry cash around,” said Chi, founder of Dexta Pharmacy.

Samson, founder of Taobab Pharmacy, said, “When running a pharmacy, there are two sets of people you must never owe: your staff and your suppliers. I can’t go too deep right now, but just know your business will get in trouble.”

According to the Association of Community Pharmacists, almost half a million people pay for something at pharmacies daily. Moniepoint revealed that only 7.69 percent of customers prefer to pay pharmacies exclusively with cash.

45.39 percent of customers pay digitally, with 46.92 percent favouring a mix of cash and digital payment methods. The payment company that this trend presents an opportunity to improve the payment experience for both well-known and new customers at community pharmacies.

“Adopting reliable payment methods can enhance relationships with existing customers and help to build strong relationships with new ones,” it said.

According to Moniepoint’s report, digital health in Nigeria is set to reach a revenue volume of over $1.3 billion by 2025, with a 22.31 percent annual growth rate, achievable with innovation in frontline healthcare.

Despite this, Nigeria only has about 35,000 primary healthcare centres (PHCs), of which only 50 percent are fully registered, licensed, and operational.

Starting a pharmacy is expensive; most get their funding from their savings.

“Personal savings (41.9 percent) is the highest source of funding for pharmacies, with loans from family and friends taking 17.9 percent.

“Only 17.2 percent of pharmacies get loans from banks and financial institutions, and 8.2 percent get loans from cooperatives. Other sources of funding include gifts from family and friends (7.2 percent), grants from government or other bodies (3.1 percent), crowdfunding (2.4 percent), and private equity and venture capital taking 2.1 percent,” the report added.