Lendsqr, a loan management software provider for banks, microfinance institutions, and digital lenders, has launched an on-lending initiative to strengthen Nigerian lenders’ capacity to extend credit to their customers.

Through this initiative, Lendsqr intends to set up a capital pool of up to N1 billion line of credit for lenders targeted at lenders with state moneylender or cooperative licenses, giving them the much-needed access to capital that can drive sustainable growth and expansion.

“For a long time, we believed that providing top-tier lending technology was enough to help lenders scale,” said Adedeji Olowe, chief executive officer of Lendsqr. “But technology alone cannot scale a loan business without adequate capital. That’s why we decided to go a step further and solve this critical need.”

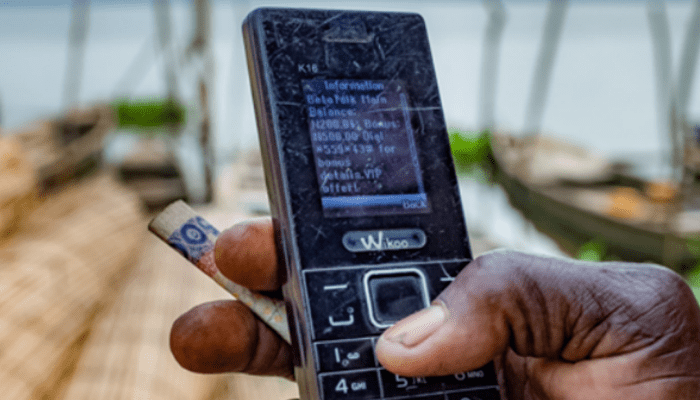

The on-lending model is also designed to support digital lenders who face challenges accessing loan capital, allowing them to access credit at a reasonable rate. Rising hardship in Nigeria has led to a surge in personal loans, which surged by 29.28 percent year-on-year to N7.52 trillion in March 2024.

Read also: Digital leaders chart course for AI compute-driven economic transformation

This increase in consumer credit can be attributed to the increasing popularity of loan apps, whose number grew to 311 in September 2024 from 173 in April 2023.

“Demand for loans has increased doublefold because of the hardship in the country, and a lot of people are turning to loan apps,” said Gbemi Adelekan, president of the Money Lenders Association, the umbrella body of registered digital money lenders in Nigeria.

A recent report from Piggyvest revealed that four in 10 Nigerians are in debt, and 26 percent owe loan apps. Another study by SBM Intelligence found that 27 percent of Nigerians across different income categories now turn to loan apps to cope with their living expenses amidst record inflation.

According to Lendsqr, its initiative will address immediate funding gaps for digital lenders trying to reach more customers.

“We’re excited to be the catalyst for growth in Nigeria’s lending sector. Our onlending initiative isn’t just about providing capital. It’s about enabling a stronger and more inclusive financial ecosystem where every licensed lender, big or small, can thrive,” added Joy Bello, Head of Sales at Lendsqr.